|

|

|

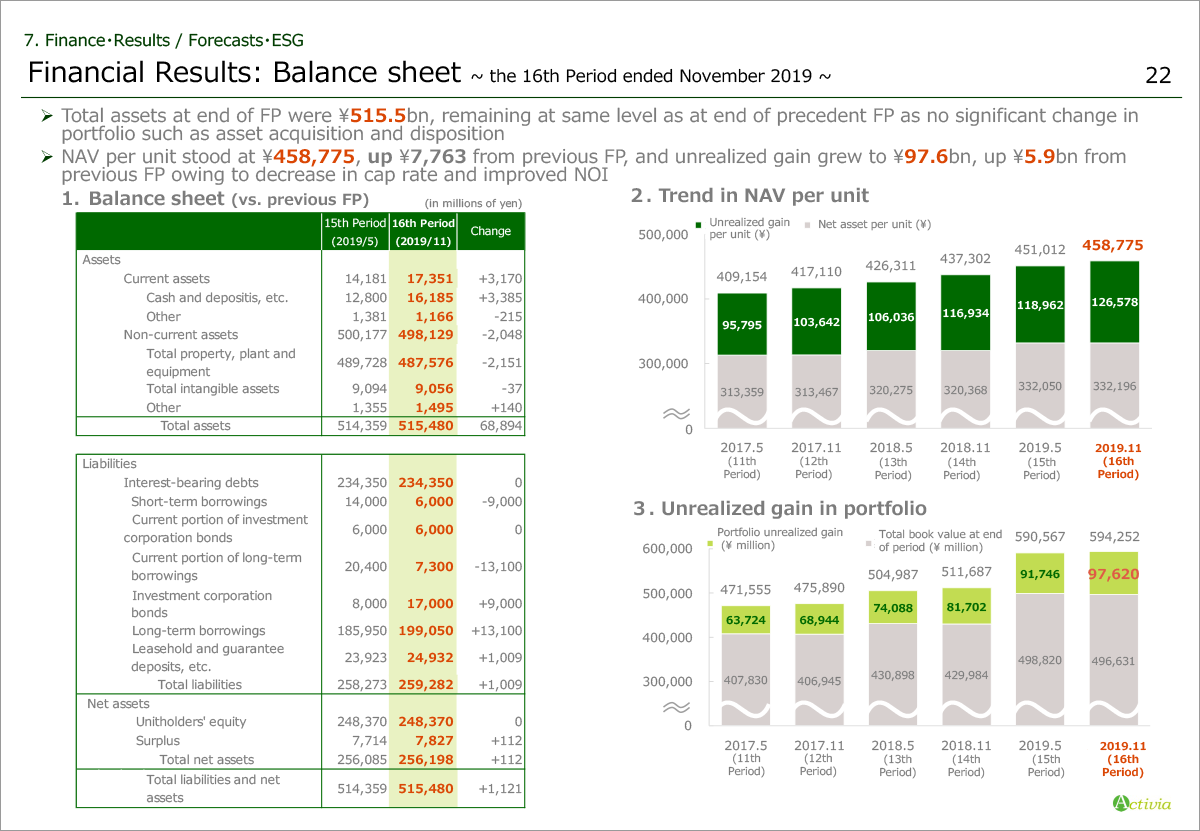

This page shows the balance sheet for the period ended November 2019 and trends in NAV per unit.

As to the balance sheet, total assets at the end of the period ended November 2019 were ¥515.5 billion, with total liabilities of ¥259.3 billion and total net assets of ¥256.2 billion.

As shown in the right side of the page, NAV per unit stood at ¥458,775, increased by ¥7,763 from the previous period owning to increase in unrealized gain by ¥5.9 billion as shown in the bottom.

Unrealized gain grew to ¥97.6 billion as a result of the increase in appraisal value owning to decrease in cap rate and improved NOI.

Please move on to the next page.

|

|

|