|

|

|

|

|

|

|

|

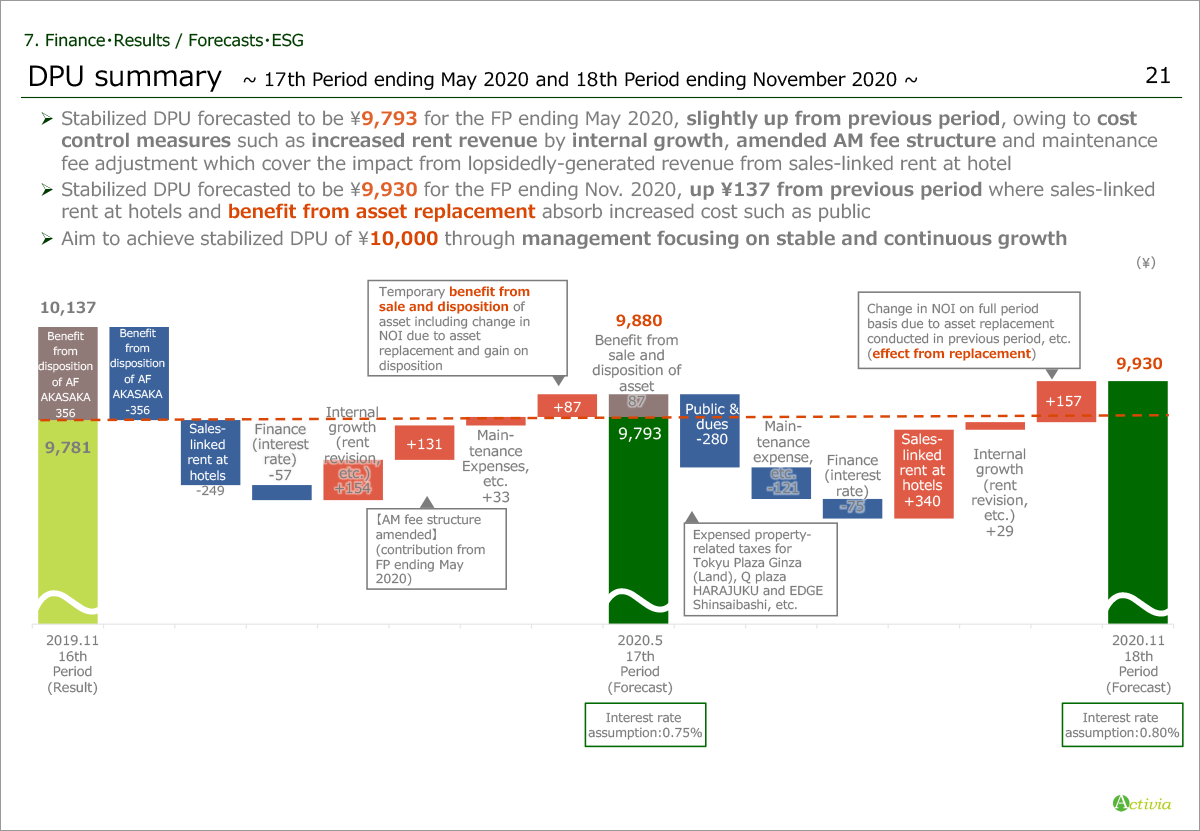

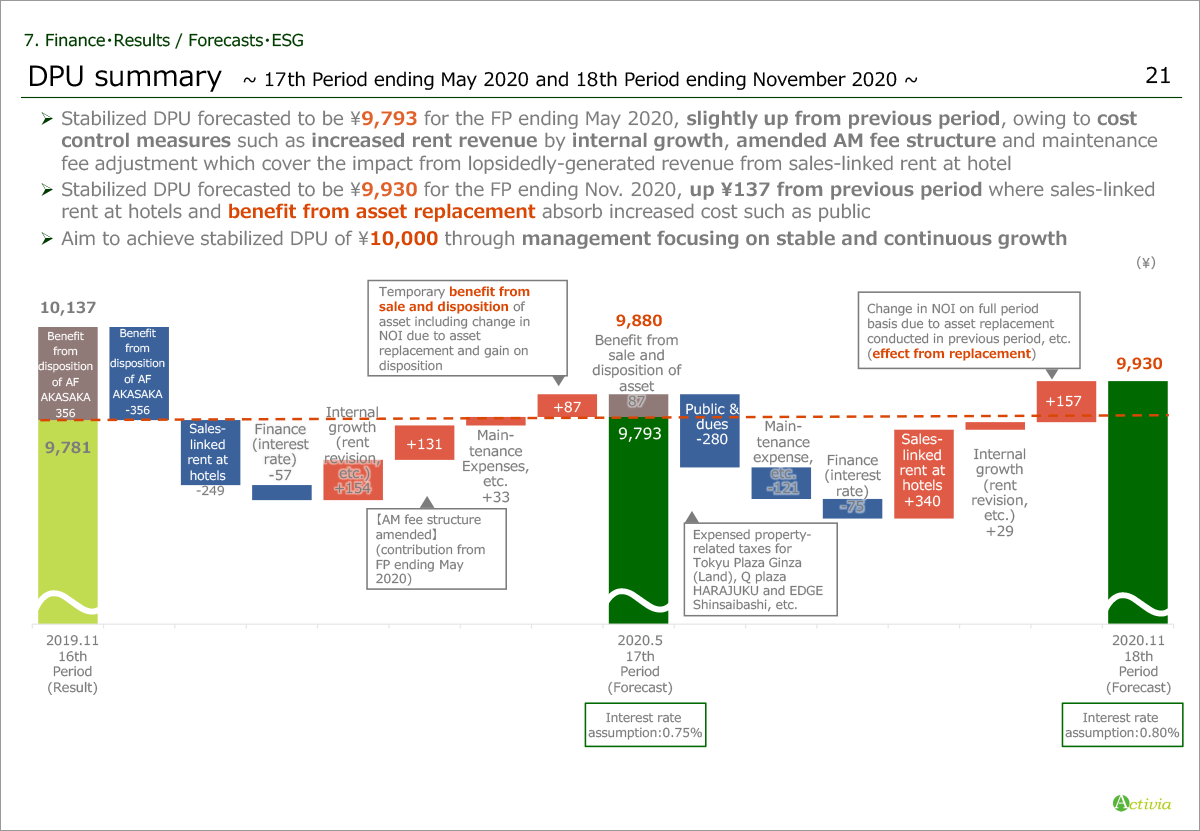

This page shows DPU forecast summary for the periods ending May 2020 and November 2020.

Please refer to the below graph.

For the period ending May 2020, stabilized DPU is forecasted to be ¥9,880, or up ¥12 from ¥9,793, the previous period result on stabilized basis. Although revenue decreases due to a fluctuation of sales-linked rent at hotels, increase in revenue through internal growth, management fee structure change and cost control measures such as reduction of maintenance expenses will absorb such decreases.

For the period ending November 2020, DPU is forecasted to be ¥9,930, up ¥137 from the previous period forecast on a stabilized basis owning to increase in revenue from sales-linked rent at hotels and asset replacement, covering increase in expenses such as property related taxes to be newly expensed from three properties acquired in 2019 and repair & maintenance expenses, etc.

We will continue management with focus on stable and continuous growth in DPU by 2-3% per year to make early achievement in stabilize DPU at ¥10,000.

Please move on to the next page.

|

|

|