|

|

|

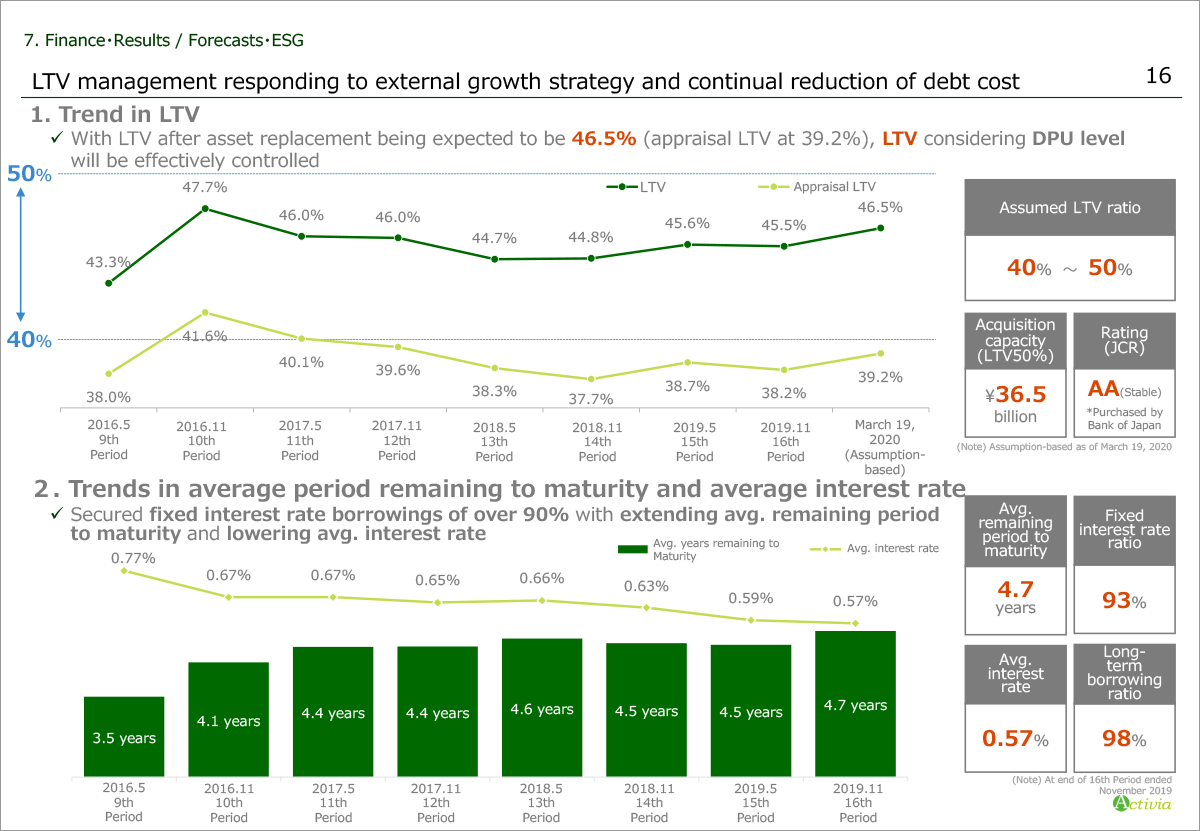

Page 16 and 17 show financial management status.

LTV as of the end of November 2019 stood at 45.5% and we assume LTV will be 45.6% after the asset replacement.

It has been still managed between 40% to 50%, a standard LTV range but we do not have an intention to raise LTV further and would like to control LTV through one to two years operation.

Please refer to the bottom.

From the period ended May 2017, we have lowered average interest rate along with maintaining average period remaining to maturity, and average interest rate and average period remaining to maturity for the period ended November 2019 stood at 4.7 years and 0.57%, respectively.

|

|

|