|

|

|

|

|

|

|

|

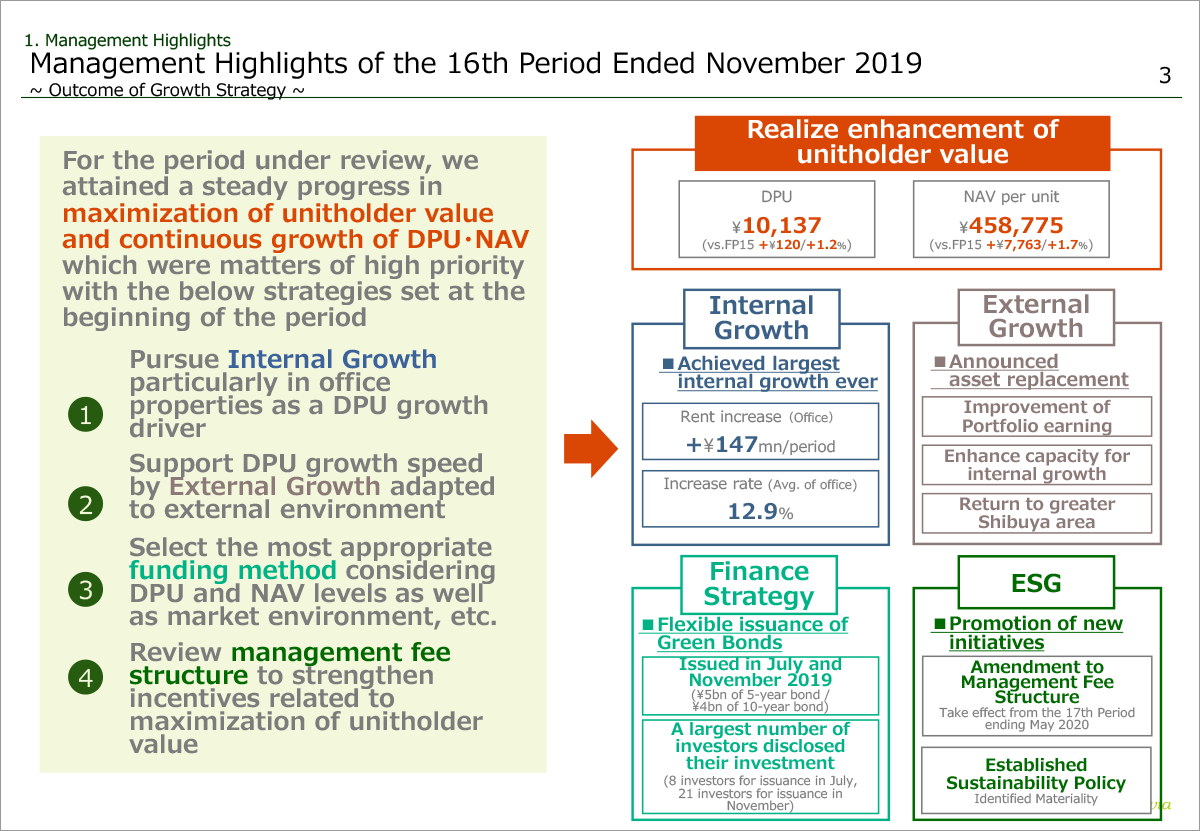

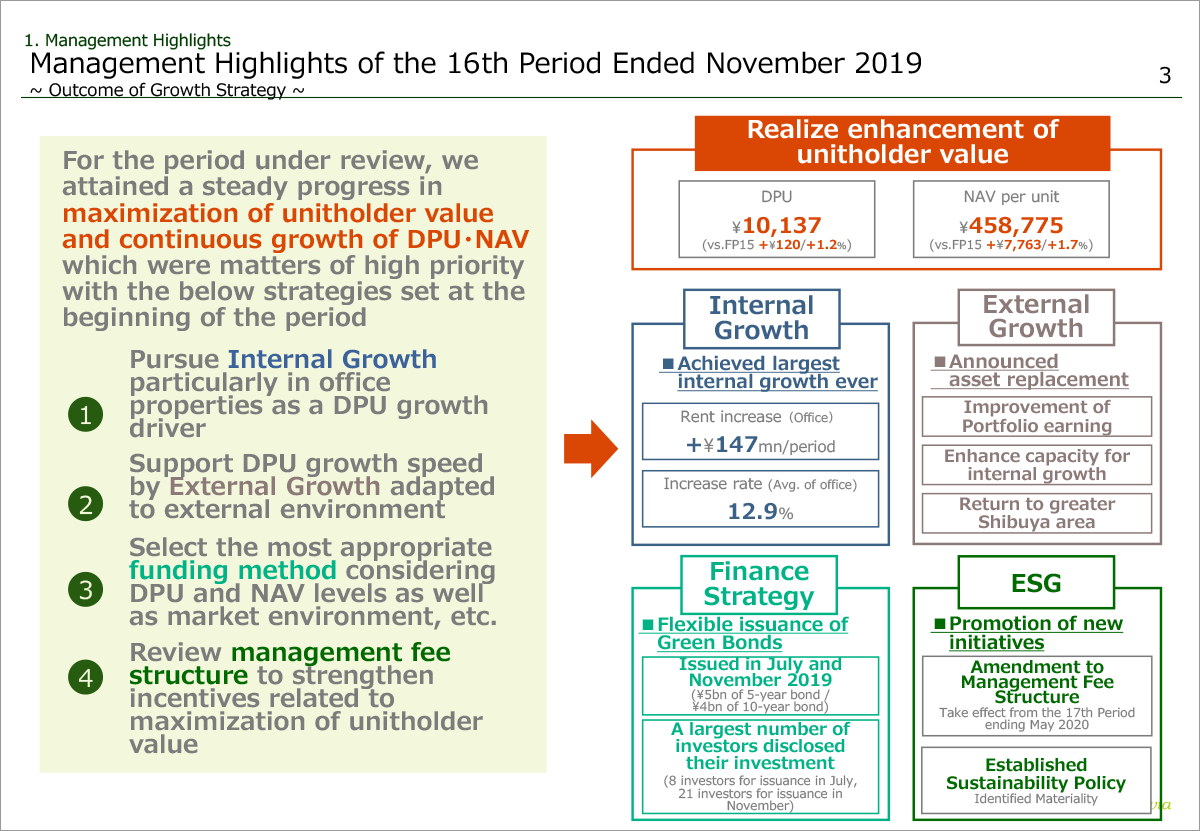

This page shows the highlights for the period ended November 2019.

Please see the left side.

For the period ended November 2019, we have solidly promoted below four strategies as explained at the previous financial presentation meeting;

Strategy one: pursue internal growth mainly in office properties as a DPU growth driver

Strategy two: support DPU growth speed by external growth adapted to external environment

Strategy three: select the most appropriate funding method considering DPU and NAV levels as well as market environment, etc.

Strategy four: review management fee structure to strengthen incentives related to maximization of unitholder value

As a result, DPU for the period ended November 2019 was ¥10,137, up by ¥120 from the previous period, and we have increased DPU for a 12th consecutive period. NAV for the period ended November 2019 stood at ¥458,775, up by ¥7,763 from the previous period owning to an increase in unrealized gains, which realized continuous enhancement of DPU and NAV.

Particularly for internal growth as a main driver of DPU growth, we made approximately ¥150 million

rent increase with an average increase rate of 13.0%, as the largest internal growth ever, owing to both rent revision and tenant replacement.

For the external growth, with a view to improve profitability of our portfolio and support DPU growth, we announced an asset replacement in November 2019, which is composed of disposition of A-PLACE Shinbashi Ekimae and acquisition of Ebisu Prime Square, a large-scale office building located in greater Shibuya area which has high growth potential.

For the finance strategy, the first green bonds were issued in July and then we issued the second green bonds in November, raised a total of ¥9 billion.

For ESG, we have promoted new initiatives such as revision of our asset management fee structure to make close alignment with unitholders and enhancement of disclosure.

Please proceed to the next page.

|

|

|