|

|

|

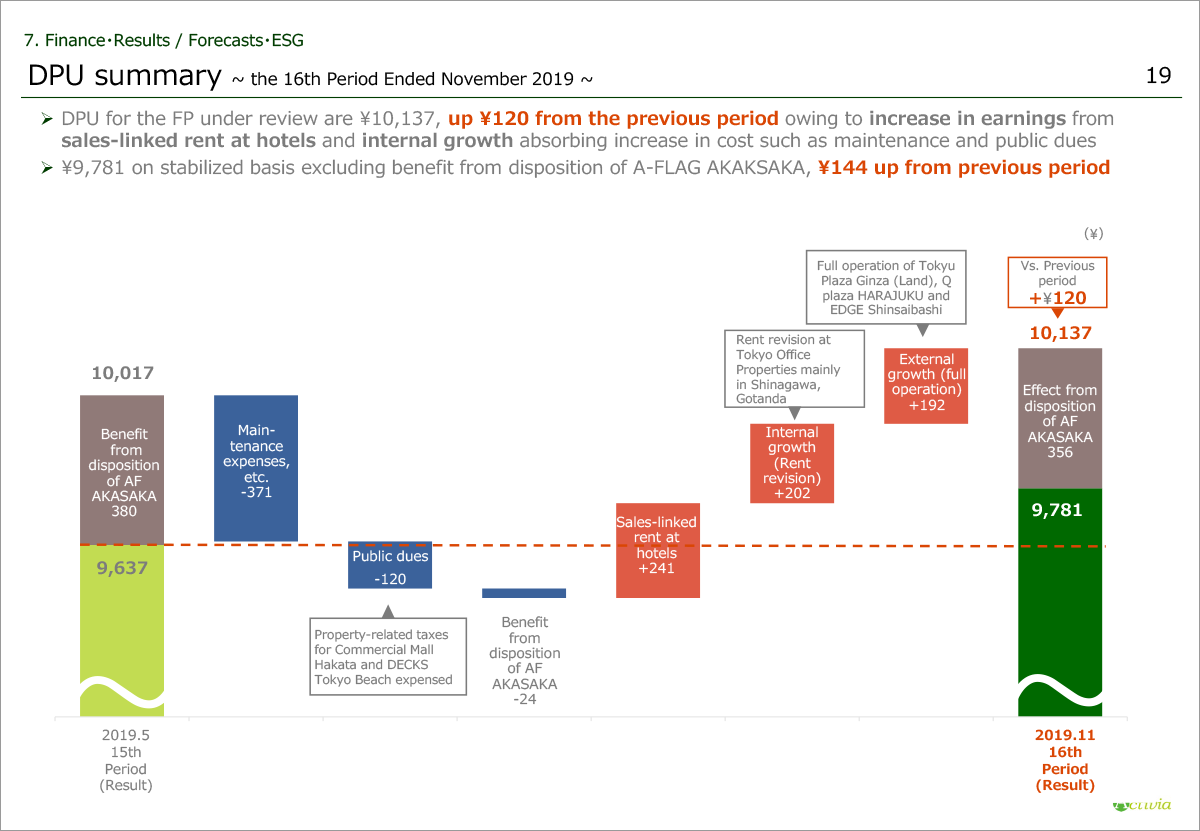

This page shows DPU summary for the period ended November 2019.

Please refer to the bottom graph.

DPU for the period ended November 2019 reached ¥10,137, up ¥120 from the previous period result owning to increase in revenue from sales-linked rent at hotels, internal growth mainly in Tokyo office and full period contribution of three properties acquired in 2019, covering increase in expenses such as repair & maintenance expenses, etc. in existing properties, also property-related taxes newly expensed from two properties acquired in 2018.

Stabilized DPU excluding effect from disposition of A-FLAG AKASAKA which were held in two time in March and June 2019 was ¥ 9,781, up ¥144 from the previous period result.

Please move on to page 21.

|

|

|