|

|

|

|

|

|

|

|

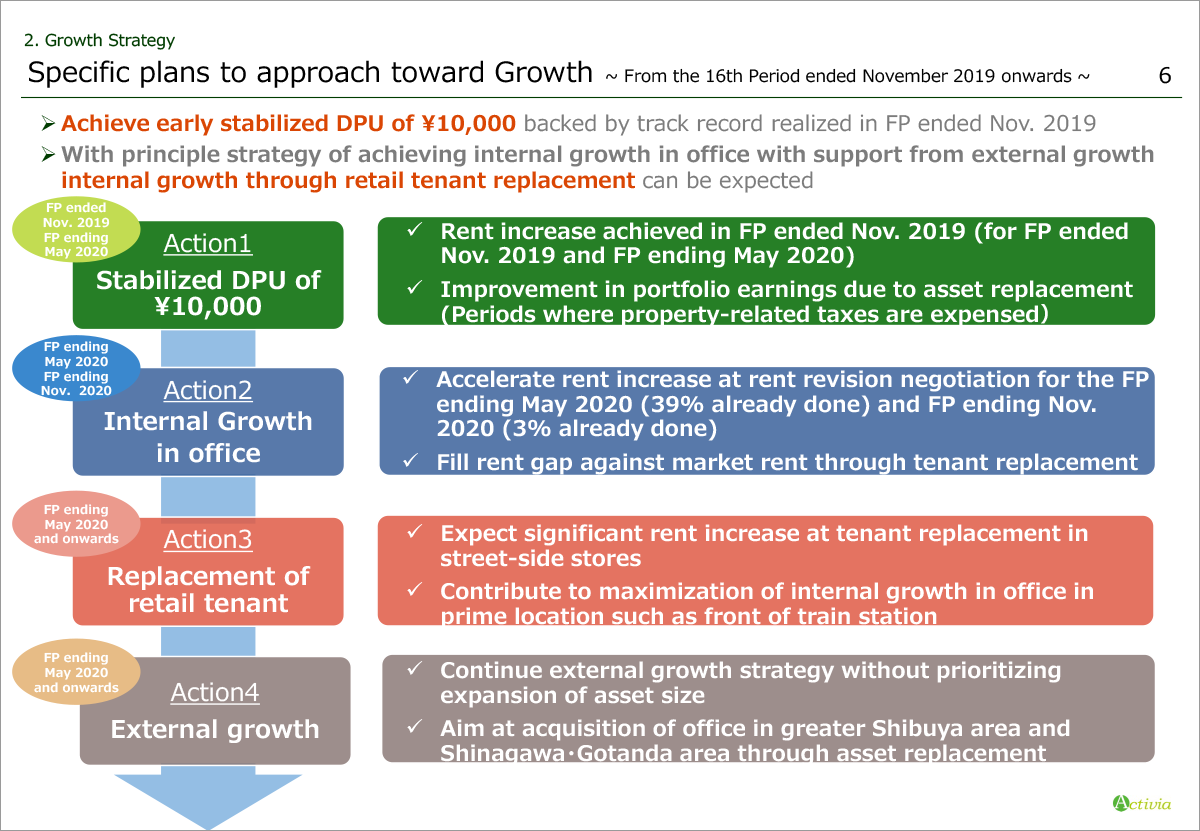

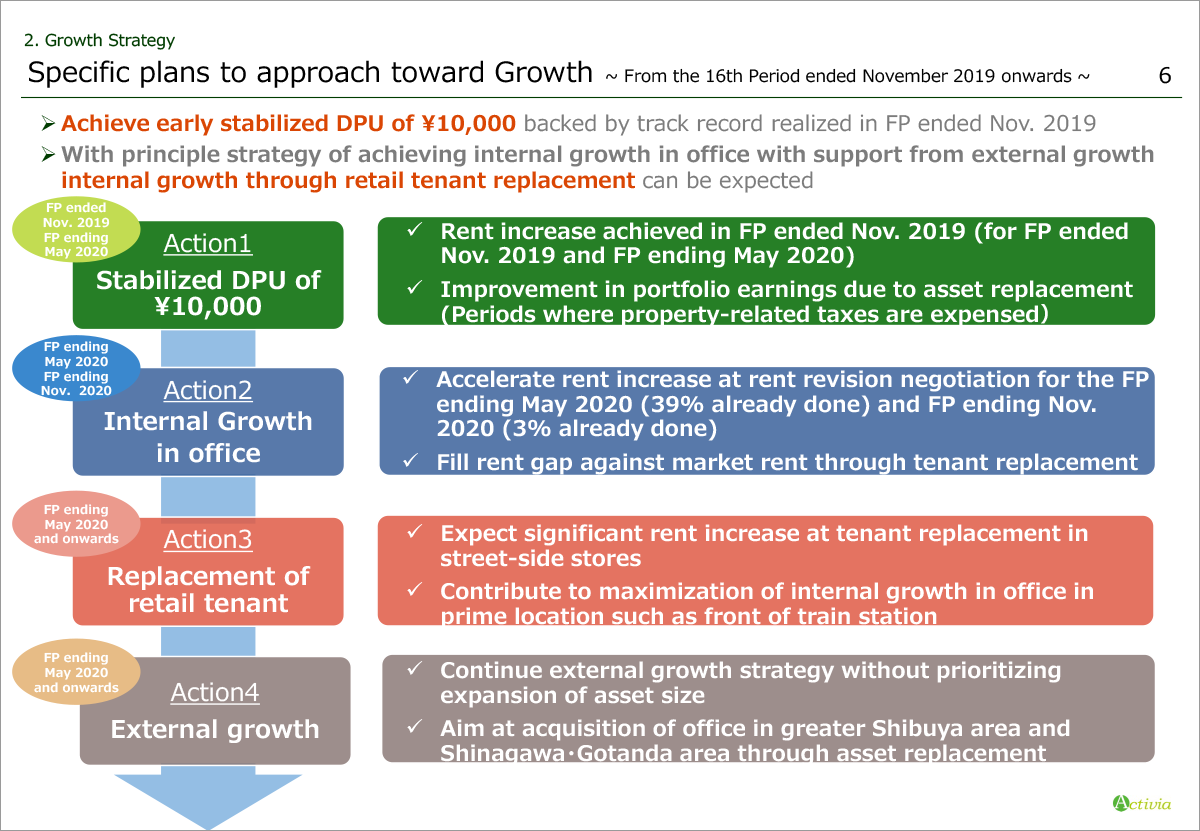

Our strategy has not been changed, and from the period ending May 2020 and onwards, we will focus on internal growth through mainly in office and we may leverage external growth to accelerate DPU growth.

By following this policy, for the period ended November 2019, we are able to have the largest scale of internal growth in overall offices since IPO and announce to conduct an asset replacement to acquire Ebisu Prime Square.

Based on these results, four actions toward our growth are shown;

In Action one, as previously explained, with internal growth in office already achieved in the period ending May 2020 and asset replacement, we have confidence in being able to accelerate target timing of achievement in stabilized DPU of ¥10,000 by approximately one year while an original target timing was said to be two to three years from the previous financial presentation meeting.

However, DPU ¥10,000 on stabilized base is not our goal.

For the period ending May 2020 and onwards, we will continuously make efforts to achieve internal growth in office and tenant replacement in retail properties which are not reflected in our present forecasts. Though, by taking in outcome from those measures, we expect growth by approximately ¥300, and based on this, for coming two years, we will grow DPU by 2-3 % per year in average.

Particularly in office, large rent revision is expected for the periods ending May and November 2020 and we will firmly manage internal growth as Action two.

Further, in Action three, we have added a tenant replacement in retail as an internal growth driver to prove that our Urban Retail properties, selected by location and quality, have both stability and sufficient growth potential.

As to American Eagle Outfitters which was our previous tenant in Tokyu Plaza Omtoesando Harajuku, we have proactively engaged in leasing in order to have outcome in early timing.

Further, we have set Action four to accelerate DPU growth by external growth, as we conduct an asset replacement.

Detailed explanations on Action one to four will be made from the next page.

Please proceed to the next page. |

|

|