|

|

|

|

|

|

|

|

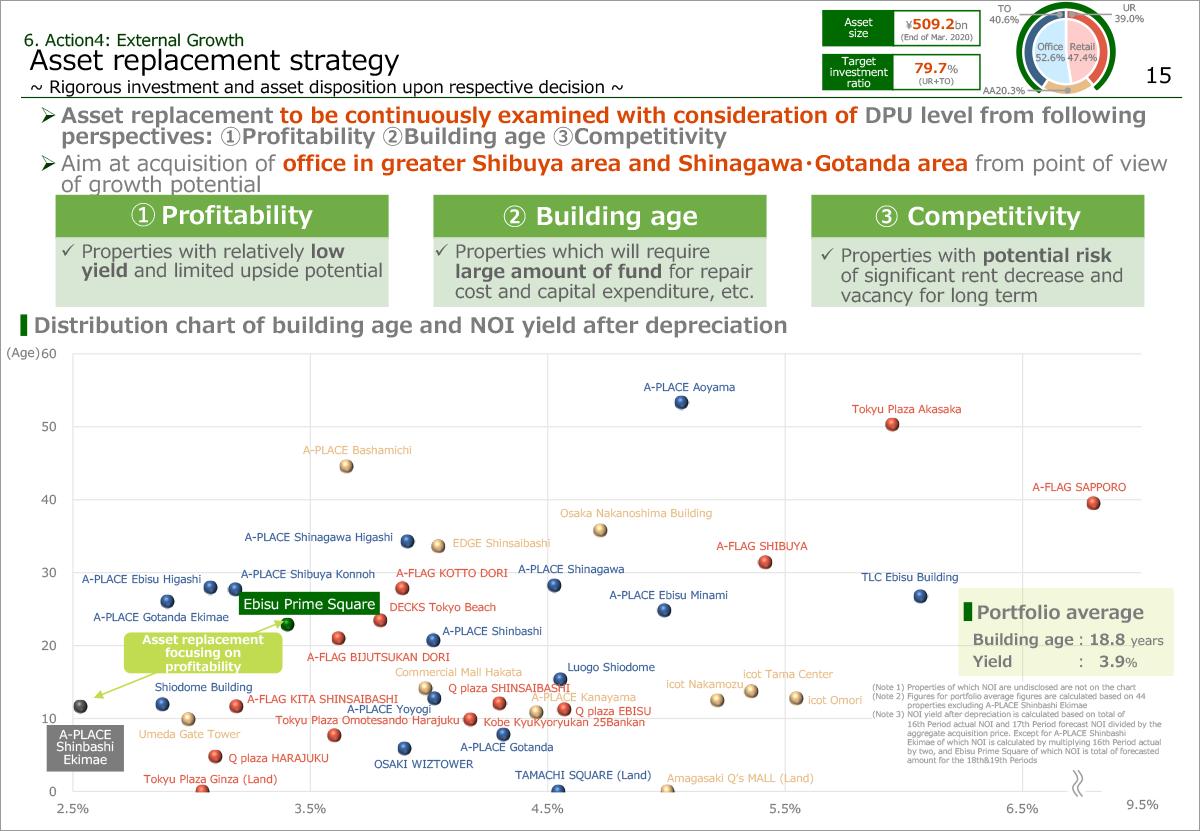

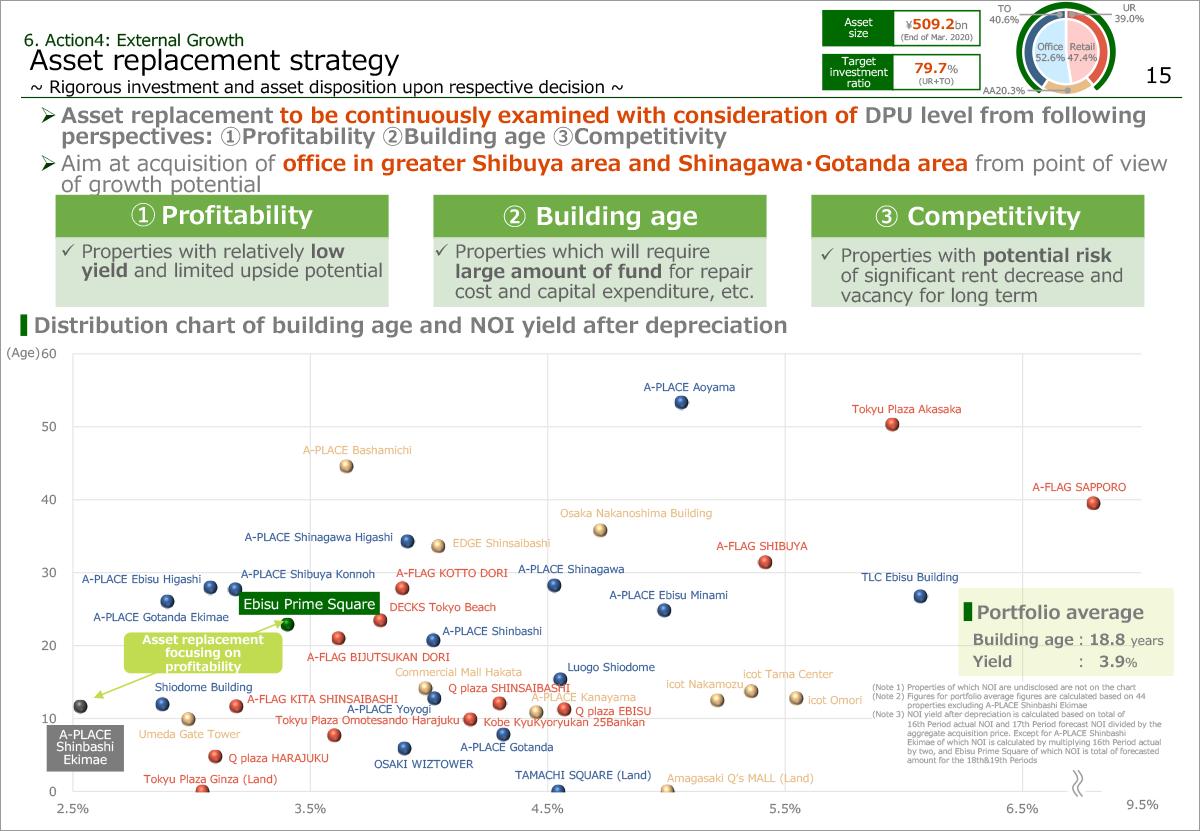

This page shows Action four, external growth.

We will work on external growth based on our principal policy; no target asset size is to be defined and pursue an opportunity to expand internal growth.

As to asset replacement, we will continuously discuss and execute.

As to properties to be disposed of, we do not assume a specific asset category such as Urban Retail or Activia Account. Rather we will make a decision based on an individual property with taking into considerations of following three points; 1. profitability, 2. building age and 3. competitiveness.

As to properties to acquire, as previously explained, our target is office located in the greater Shibuya area and Shinagawa・Gotanda area and we will work on external growth and asset replacement aiming to support DPU growth.

In the bottom, we have a distribution map of building age and NOI yield after depreciation.

As shown in the left side of the map, we decided to replace these properties with taking into 1. profitability.

Please move on to the next page.

|

|

|