|

|

|

|

|

|

|

|

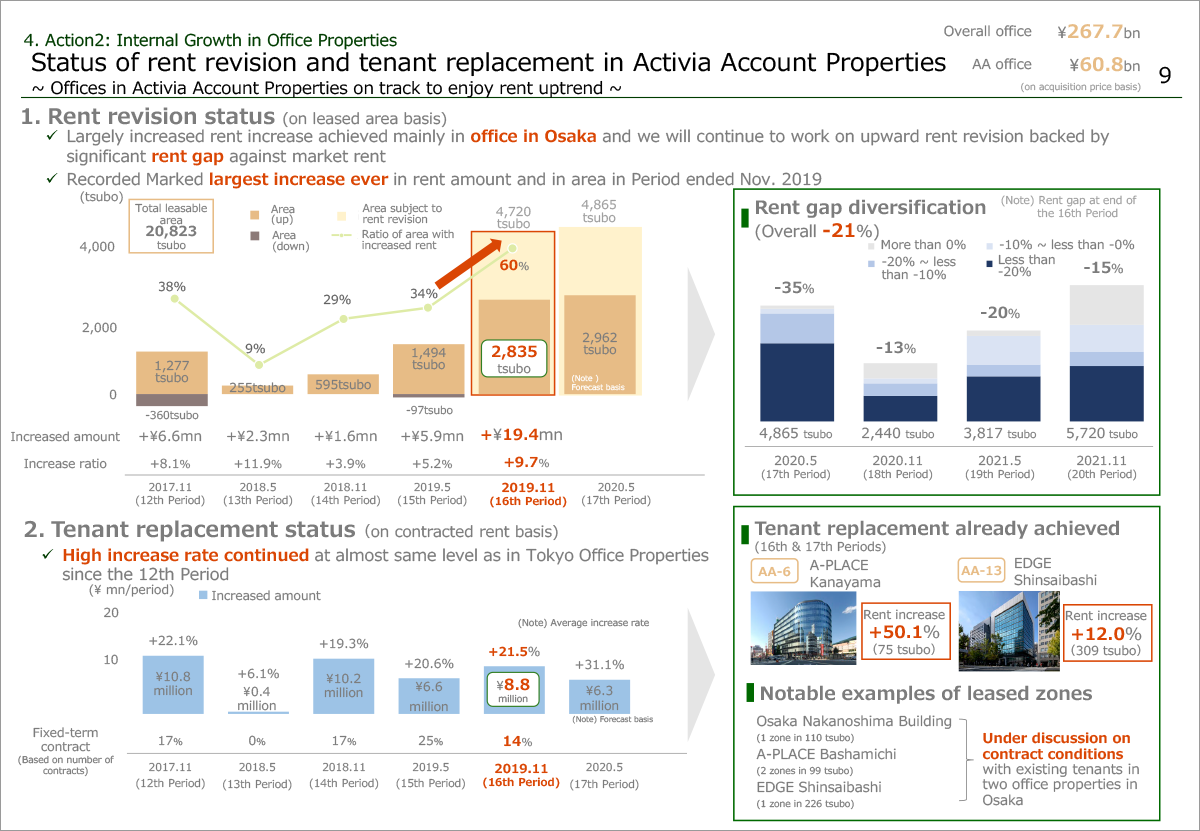

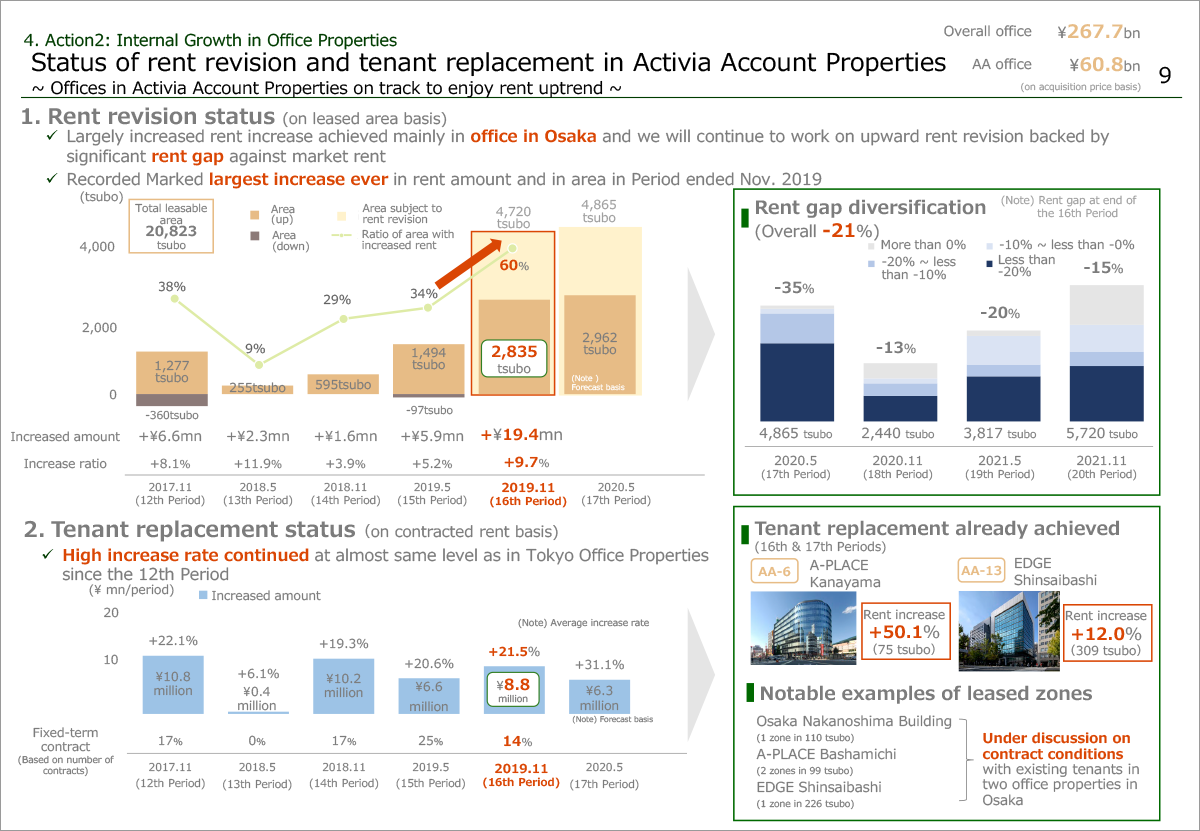

This page refers to offices of Activia Account Properties.

At the previous financial presentation meeting, we mentioned that opportunities for rent increase were increasing for Activia Account offices. And as current internal growth is very robust, we think full-scale internal growth has started from the period ended November 2019.

In rent revision, during the period ended November 2019, rent increased in 2,835 tsubo, or 60% of the area subjected to lease renewal, the largest ever, with an average increase rate of 9.7%, which accounts for ¥19.4 million per period.

Compared to offices of Tokyo Office properties, the increase amount of rent is smaller, as total leasable area and rent per tsubo are 60% of those of Tokyo office, but in terms of ratio of rent revision and average rent increase rate, figures are increasing rapidly to the same level as those of Tokyo Office.

For the period ending May 2020, negotiation with large tenants are already completed, and at present already reached to 61% of the area subjected to revision, exceeding those of the period ended November 2019 which were the highest record at the time. And we have already secured over ¥20 million for the period from rent increase.

The right side shows the diversification of rent gap against market rent.

The rent gap of overall portfolio is 21% which is wider than that of Tokyo office.

Since market trend is left behind from that of Tokyo office and also large office supply is limited in Osaka until 2022, market is tighter than Tokyo, which may lead further upside potential.

In tenant replacement, we achieved rent increase by ¥8.8million per period, up 21.5% in average rent.

Examples are shown in right and four tenant replacements in EDGE Shinsaibashi acquired in January

2019 contributed large portion.

We may leverage our know-how gained from rent revision and tenant replacement in Tokyo offices to those of Activia Account offices to pursue further internal growth.

Please proceed to the next page.

|

|

|