|

|

|

|

|

|

|

|

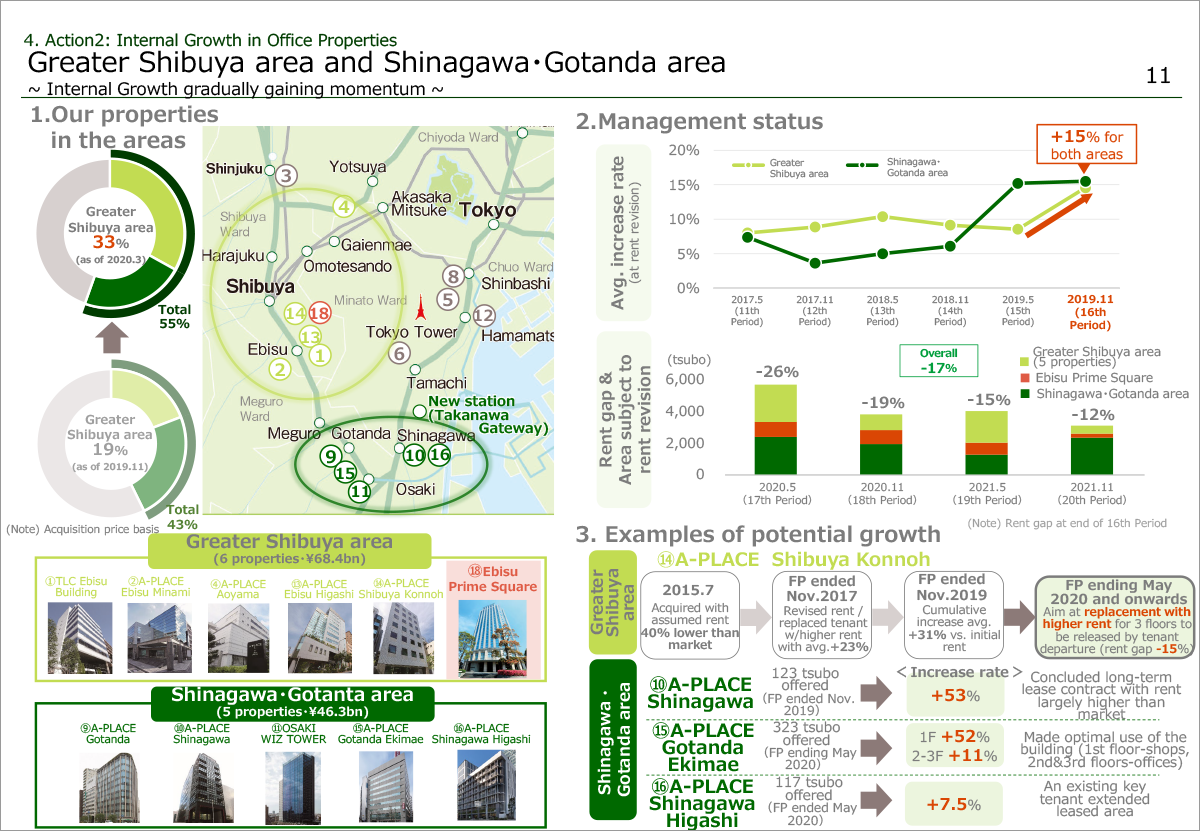

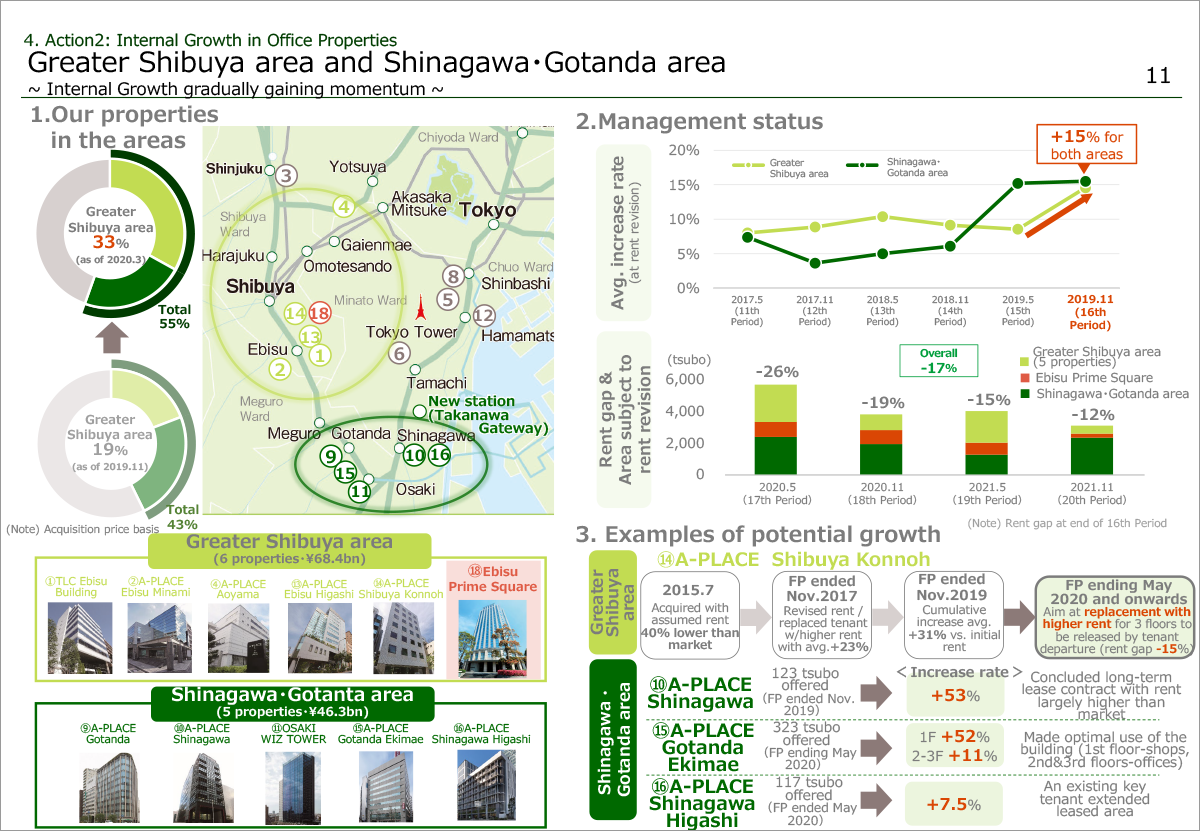

Page 11 shows our management status in Tokyo office properties in the greater Shibuya area and Shinagawa・Gotanda area, our focused investment areas.

By acquiring Ebisu Prime Square, the largest office in the great Shibuya area, the ratio of properties in that area among Tokyo Offices turned to be 33%, up by 14 points.

And together with offices in Shinagawa・Gotanda area, that ratio will rise to 55% which accounts for a major portion. The presence of the greater Shibuya area, one of our focused investment area and Shinagawa・Gotanda area is getting greater.

Upper right 2 shows trends in rent revision.

For the previous period, we have mentioned that upwards trends were accelerating in Shinagawa・Gotanda area, but for the period under review, increase rate for the greater Shibuya area grew and for both areas, rent was up by 15% in average, exceeding 12% which is the average rate of Tokyo office.

A rent gap against market rent stands at 17% for the greater Shibuya area and Shinagawa・Gotanda area, which increases an importance of its management.

In addition, as explained in page 8, over 80% of the area subjected to lease renewal of Tokyo office for the periods ending May and November 2020 is concentrated in the greater Shibuya area and Shinagawa・Gotanda area, so you can expect our internal growth.

Please proceed to the next page.

|

|

|