|

|

|

|

|

|

|

|

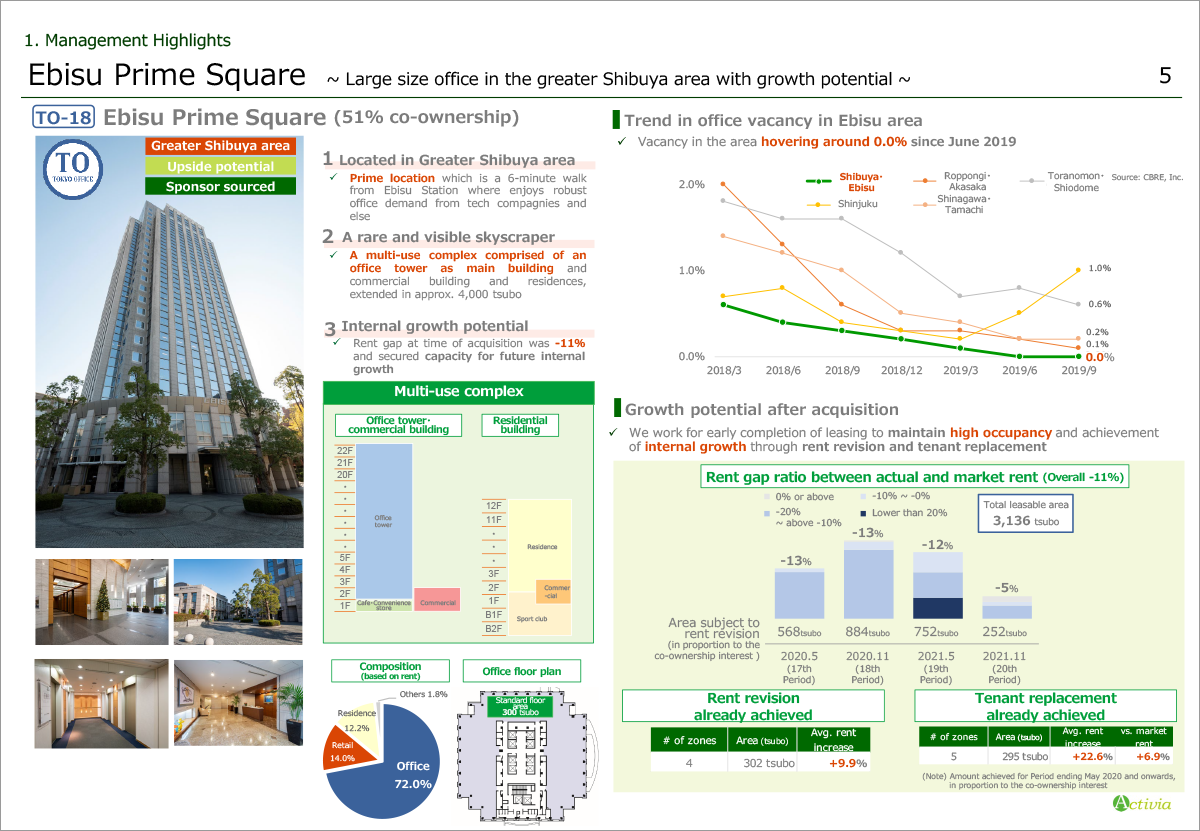

An overview of Ebisu Prime Square, the asset that we acquired, is as follows.

From a sponsor SPC, we have acquired 51% co-ownership in Ebisu Prime Square for ¥30,700 million, with 3.7% appraisal NOI yield.

Ebisu Prime Square is located in the greater Shibuya area, one of our target investment areas. And the property is comprised of three complexes, an office tower which is a visible and rare skyscraper, commercial building and residences.

Office area has a standard office floor of 300 tsubo with a layout allowing easy zoning. At acquisition, 34 office tenants including foreign capital companies and technologies firms, etc. has occupied the floors and offices has accounted for over 70% on rent basis.

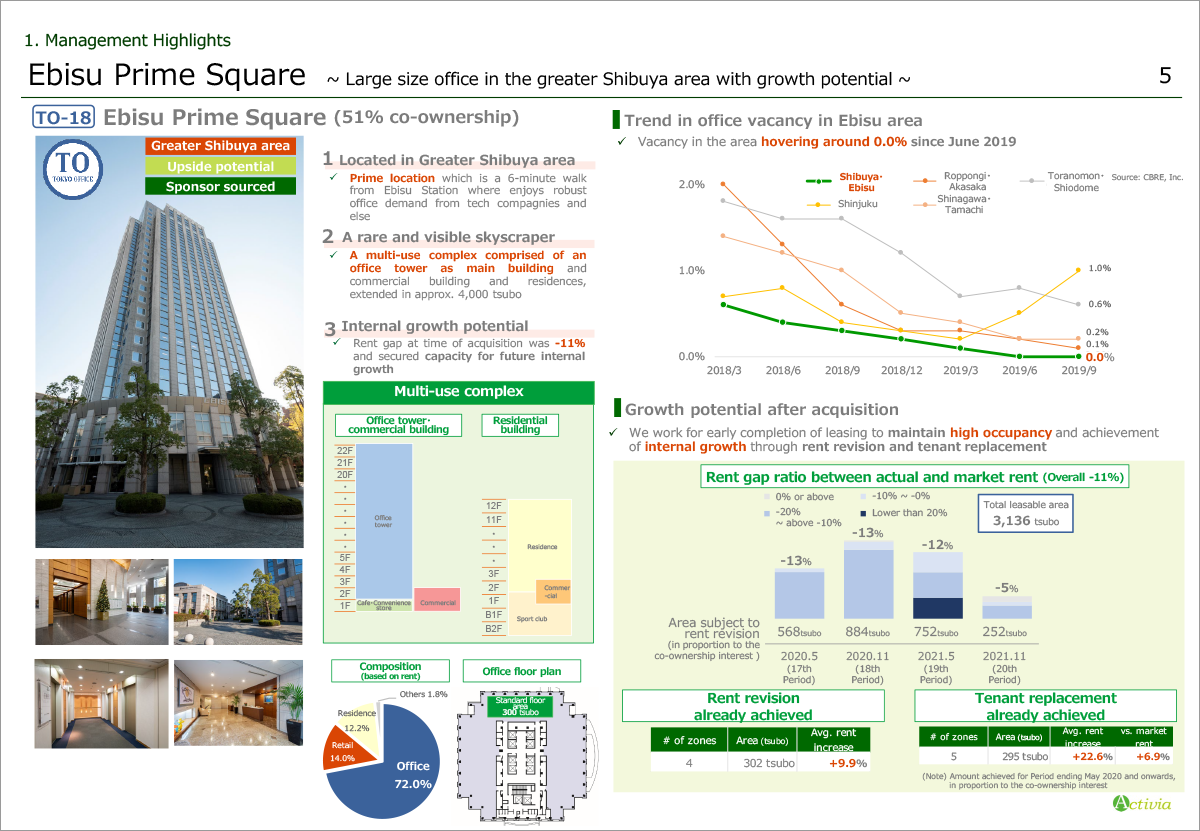

The top right shows office market condition in Ebisu area. As you may know, office vacancy in 23 wards of Tokyo is hovering at the lowest level and especially those of Shibuya/Ebisu area are 0.0% since the second quarter in 2019 for two consecutive periods, a tightening condition has been continued.

In the bottom, let us explain rent upside potential.

For Ebisu Prime Square, current market-to-actual rent is relatively large at 11%, and we have rent revision with relatively large tenants until the period ending May 2021.

Currently we are already at favorable environment for rent revision and tenant replacement.

Especially for tenant replacement, we had some cases with rent exceeding market rent. Our forecasts for budget and market rents was possibly conservative, but we will pursue further internal growth through rent revision and tenant replacement.

Please proceed to the next page.

|

|

|