|

|

|

|

|

|

|

|

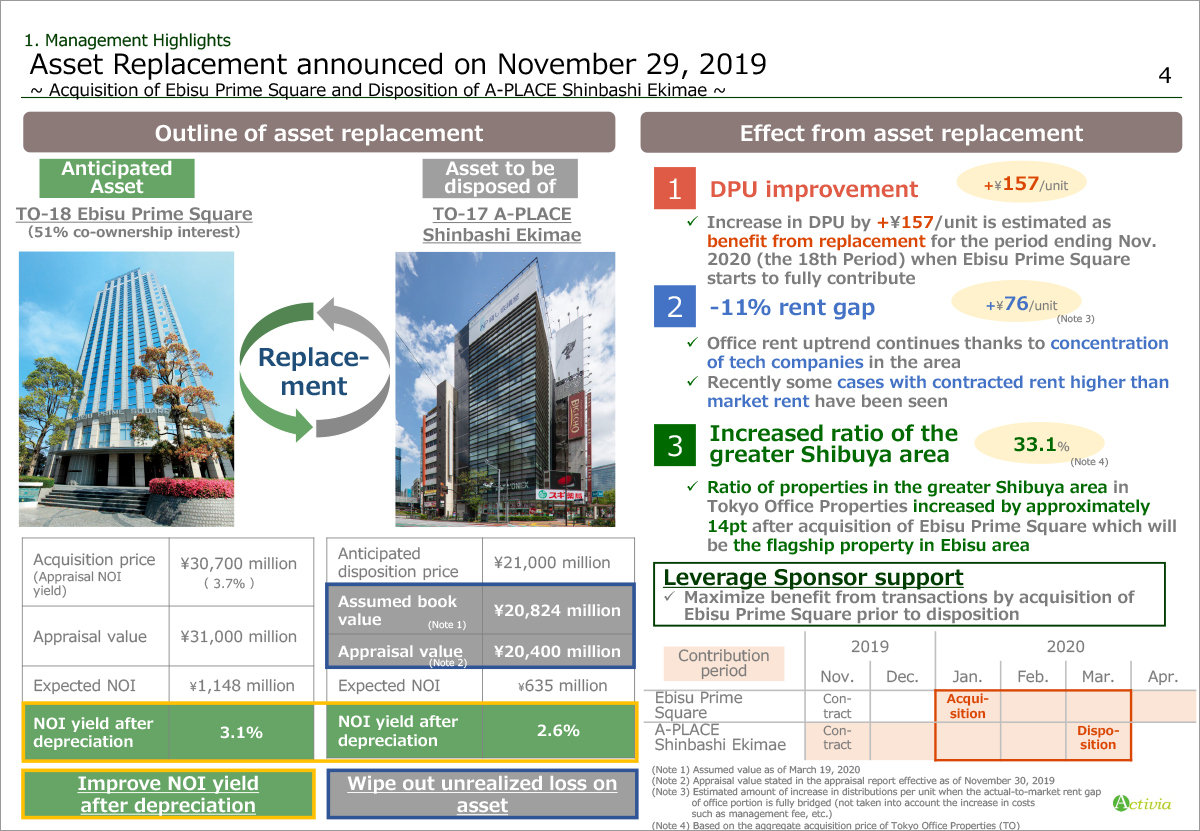

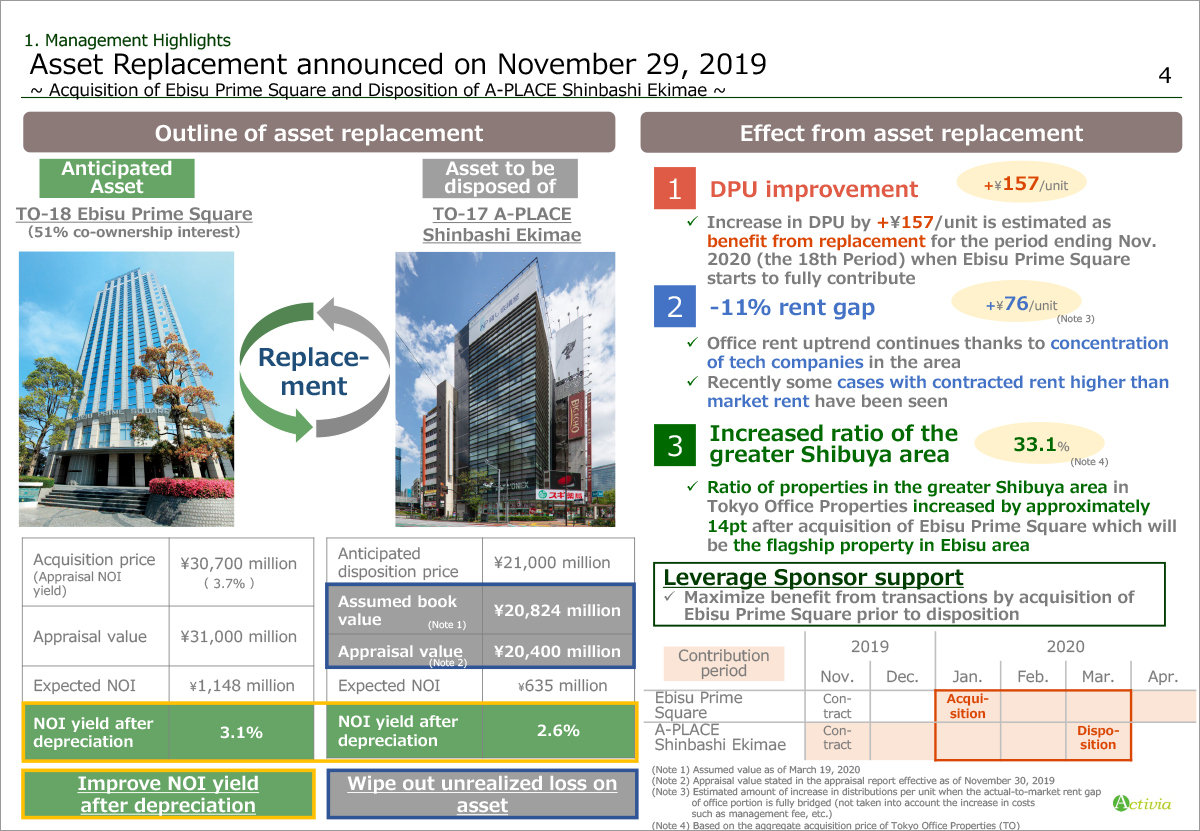

Page 4 and 5 explain the asset replacement composed of acquisition of Ebisu Prime Square and disposition of A-PLACE Shinbashi Ekimae which is announced at the end of November 2019.

As shown on the left side with highlighted in green and gray, this replacement has been conducted with a view to make early achievement of DPU at ¥10,000 through an improvement in profitability and in NAV to maximize unitholders value.

Please refer to the effect from asset replacement on the right.

The first point is an improvement of NOI yield after depreciation and we expect DPU improvement by ¥157 on a stabilized base (after property related taxes are expensed).

The second point is that an internal growth can be expected by acquiring Ebisu Prime Square which has 11% market-to-actual rent gap and we estimate DPU increase by ¥76 by filling this gap.

The third point is that the ratio of properties in the greater Shibuya area among Tokyo Offices will increase, to 33.1 %, up by 14 points.

For future acquisition, we aim to target offices in the greater Shibuya area, one of our focused investment area.

As to the transaction schedule, by leveraging sponsor support, we have maximized profit from transactions by acquiring Ebisu Prime Square prior to disposition.

|

|

|