|

|

|

|

|

|

|

|

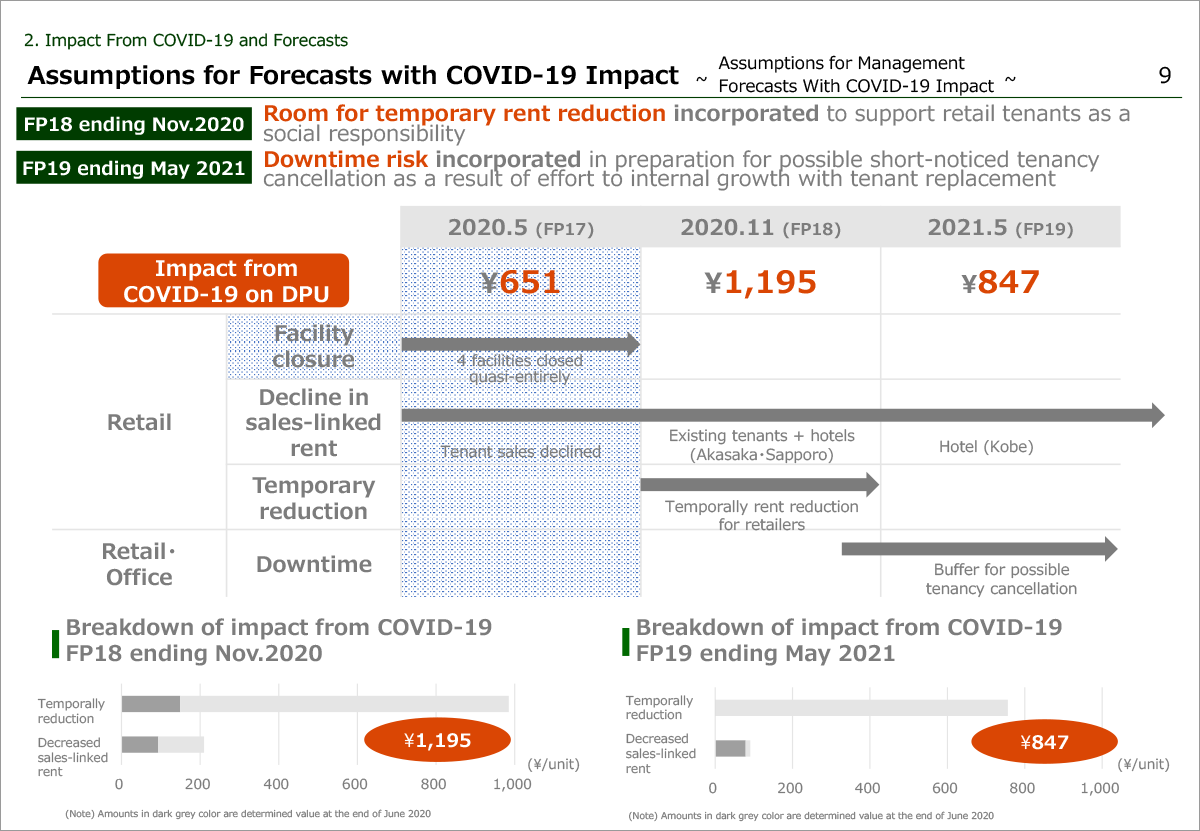

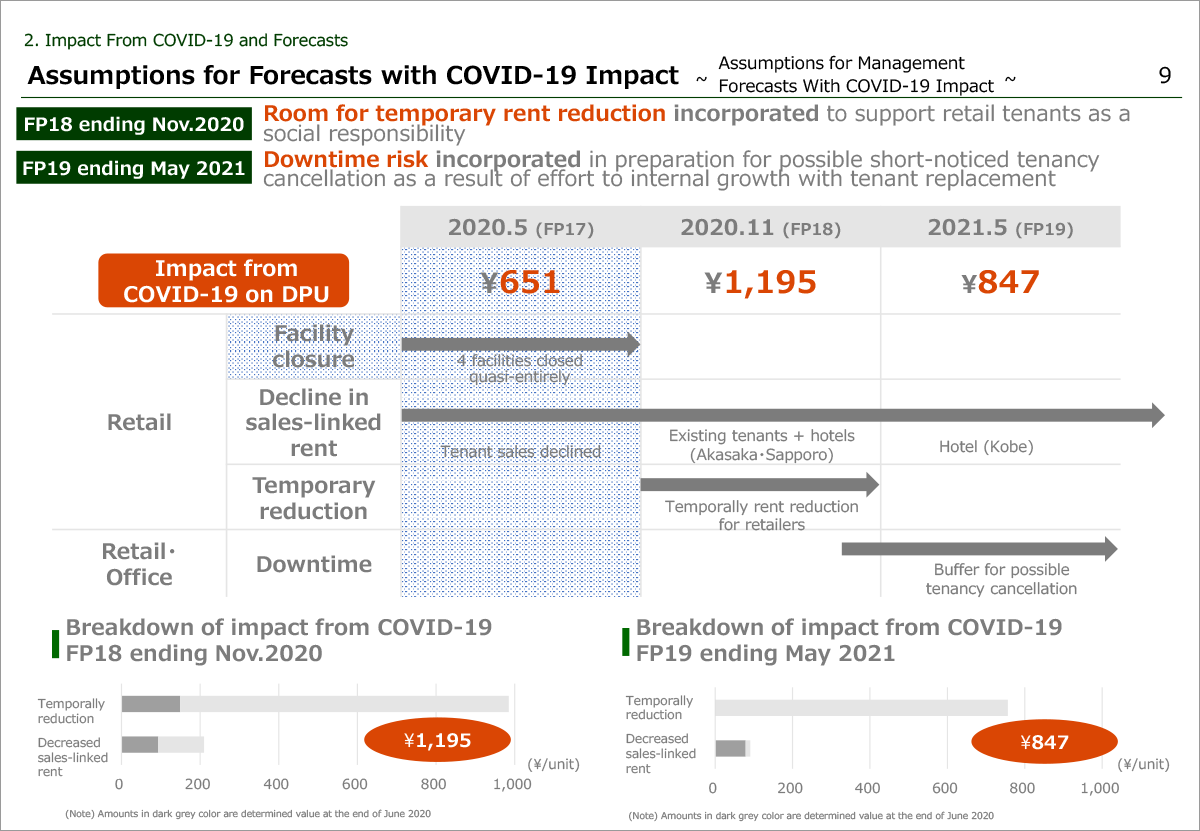

This slide explains the assumption given to the Forecast DPU with COVID-19 impact, reflecting how we respond to the crisis.

Actual DPU for the FP17 ended May, forecast DPU for the FP18 ending November 2020 and for the FP19 ending May 2021 have all already accounted for negative impact from COVID-19, reflecting ¥651, ¥1,195 and ¥847, respectively.

In this presentation, various factors amid crisis are summarized in one word “impact”, though I would like to explain here about different situation in the respective period.

For the FP17 ended May 2020, as I mentioned earlier, a major part of the amount comes from fixed-rent reduction caused by facility closure of some retail properties. And temporary reduction to support tenant business and downtime risk are two different factors incorporated into DPU respectively for the FP18 ending November 2020 and for the FP19 ending May 2021.

Decline in revenue from sales-linked rent at hotels is also reflected to the forecast DPU for FP18 ending November 2020 and FP19 ending May 2021.

In the bottom, you can see the breakdown of the decreased amount in forecast DPU for the two periods.

Amounts shown in dark grey are already confirmed at end of June, and temporary reduction in FP18 ending November 2020 reflect 36 requests already accepted explained earlier on slide 7.

For the coming periods, we will make our best effort to minimize COVID-19 impact on our DPU, same as for the FP17 ended May 2020.

Please move to the next slide.

|

|

|