|

|

|

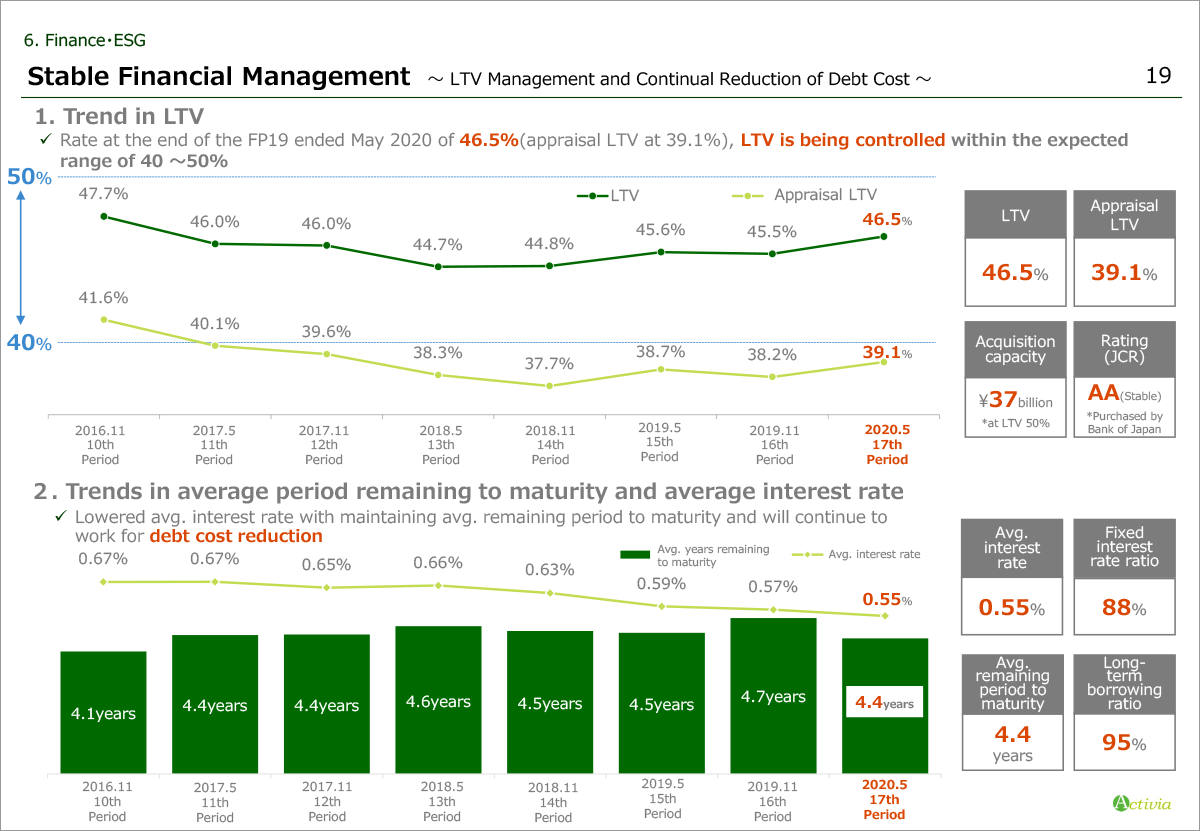

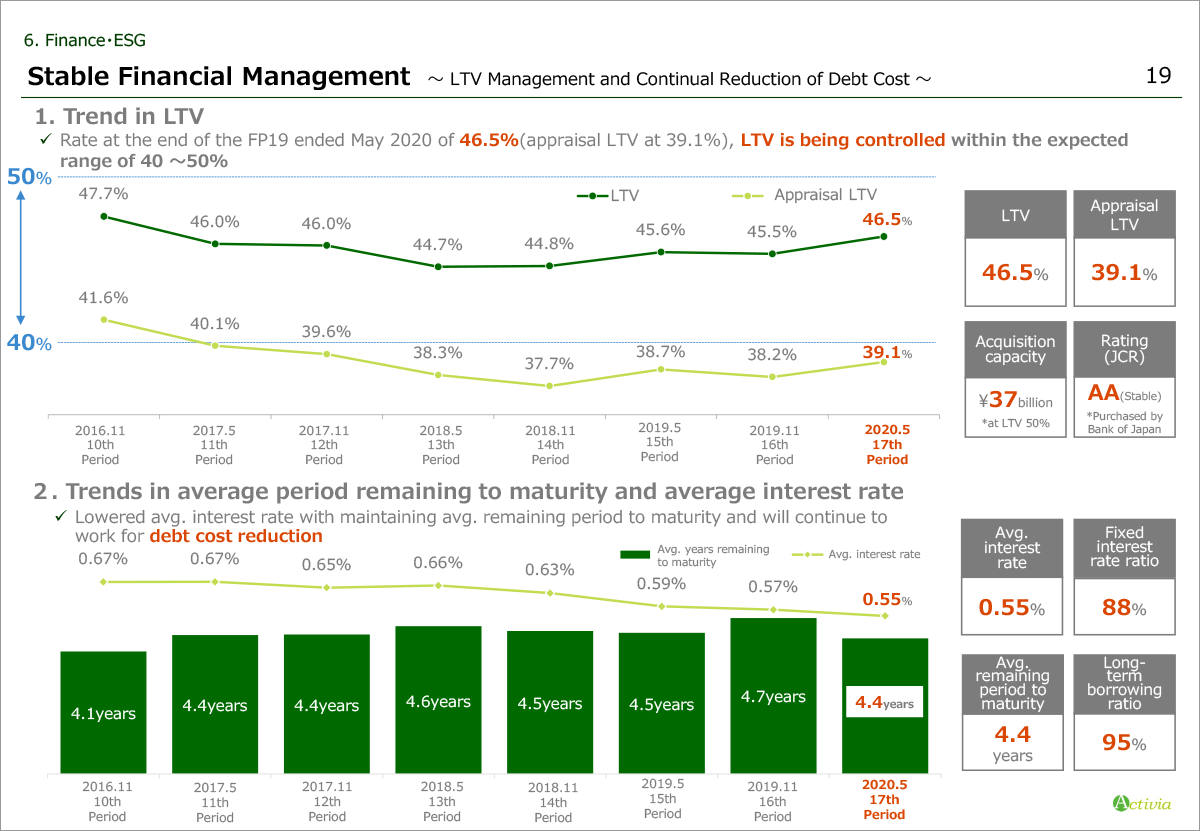

Slide 19 and 20 show financial management status.

First, LTV as of the end of May 2020 stood at 46.5%, up 1% from the end of the previous period as a result of the asset replacement held during the period which caused increase by ¥10 billion in liabilities and assets.

The capacity for acquisition assuming LTV at 50% is ¥37 billion which secures us room for flexible further property acquisition, and our long-term issuer rating of JCR is continuously rated AA (stable) and API remains the REIT purchased by Bank of Japan’s purchases.

Now please look at the bottom.

From the period ended May 2017, we have maintained average period remaining to maturity at about 4.5 years with lowering average interest rate. At the end of this period, the average period remaining to maturity was 4.4 years and average interest rate was 0.55%, 0.02% lower than the end of the previous period.

Please move on to slide 20.

|

|

|