|

|

|

|

|

|

|

|

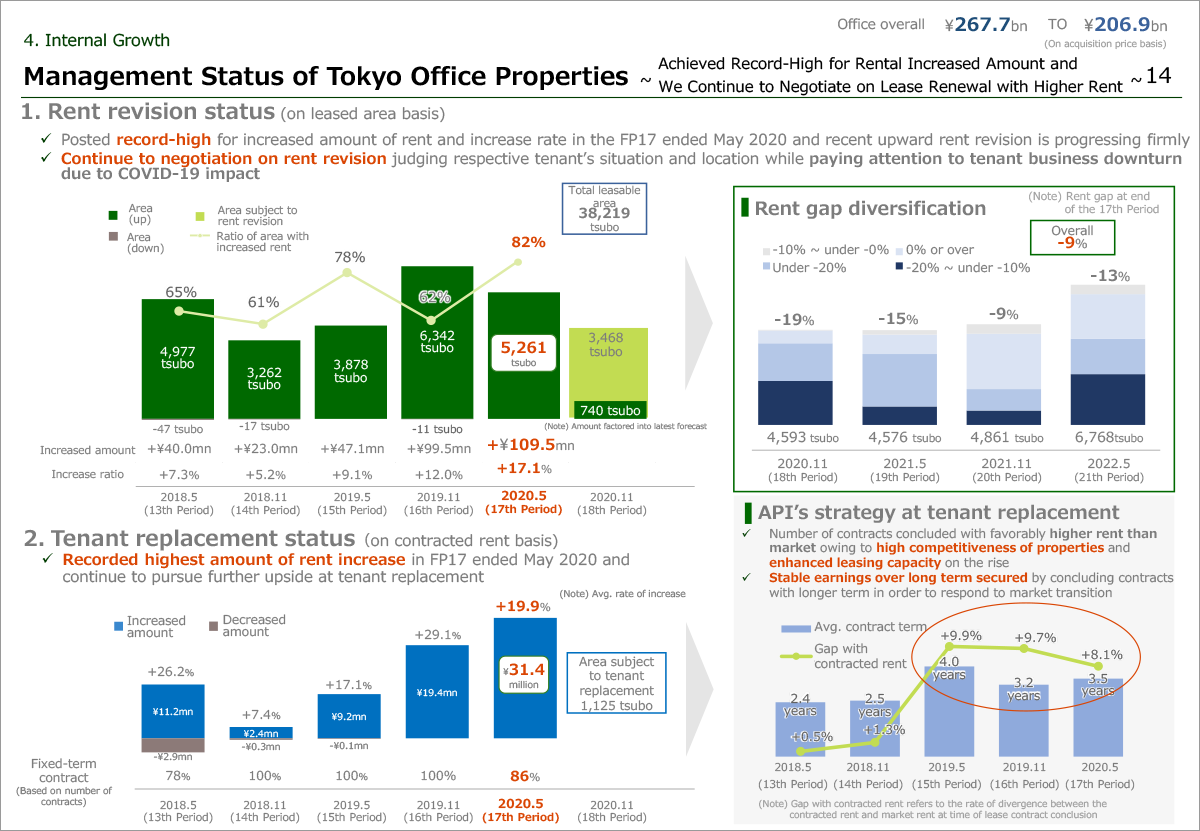

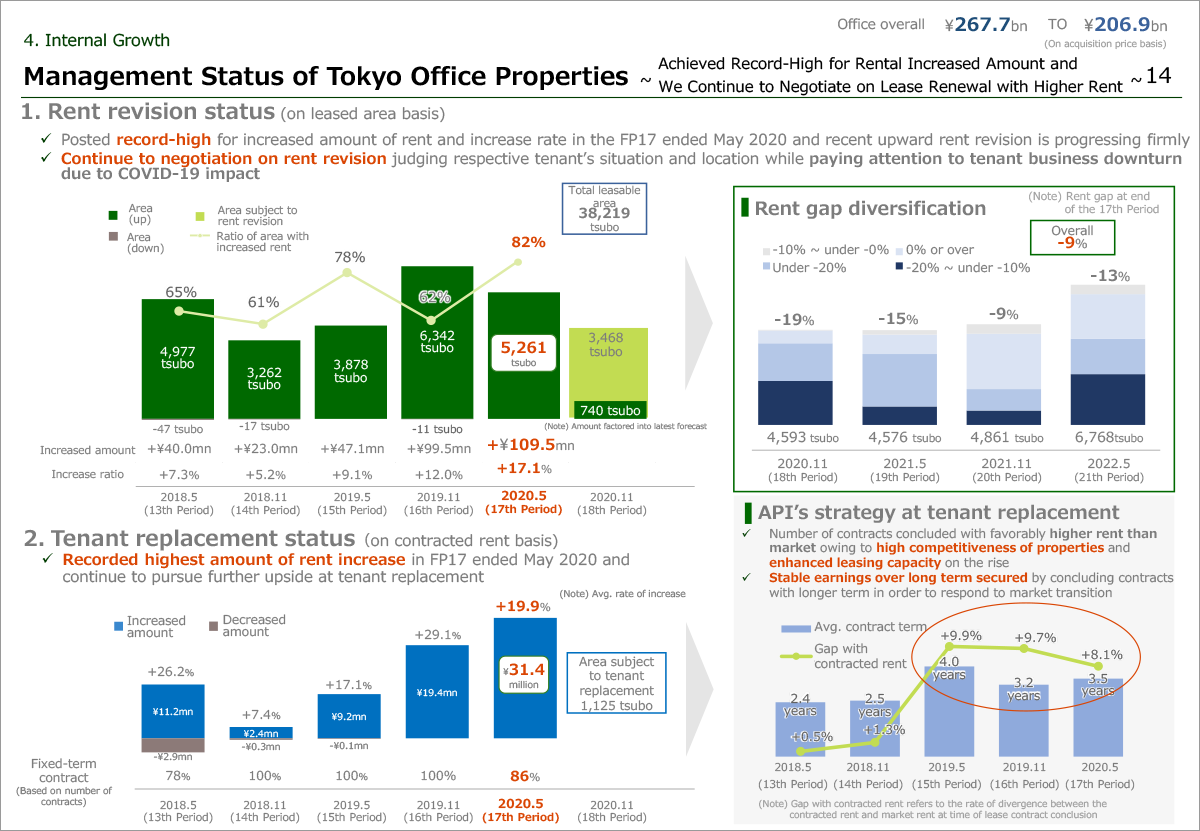

I would like to touch on rent revision and tenant replacement status in Tokyo Office properties.

There was a certain moment when any activity was suspended as COVID-19 outbreak restricted any kind of travel and we could proceed neither negotiation nor viewing of the property with tenant candidate. Even though, as demand remains strained and underlying environment is also remained favorable for rental increase, we are still at phase of pursuing to bridge the rent gap with market rent.

In the period under review, we achieved upward rental revision in 5,261 tsubo or 82% of the total area subject to rent revision and increased amount reached a record high of ¥109.5 million with an average increase rate of 17.1%.

Please take a look at the rent gap diversification on the top right.

Actual contracted rents of Tokyo Office properties in the FP ending November 2020 and May 2021 are -19% and -15% vs. market rents, having even wider gap compared to the overall portfolio of which actual-to-market rent is -9%. Taking advantage of this, we will pursue to achieve thriving internal growth through intense negotiations.

On the bottom, you can see the status of rental increase at tenant replacement.

We recorded a record high in tenant replacement as well as in rent review, with an increased amount of ¥31.4 million and an average increase rate of 19.9%.

For the period ending November 2020, approximately 1,100 tsubo are subject to tenant replacement and we can expect further strong internal growth although attention is to be paid to potential downtime and extended free-rent period.

With new tenants after replacement, we have so far worked to reach agreement on longer lease term in order to benefit earnings over long term when contracted rent is higher than market, along with securing future rent upside by contracting fixed-term lease. And we will continue to pursue such strategy.

|

|

|