|

|

|

|

|

|

|

|

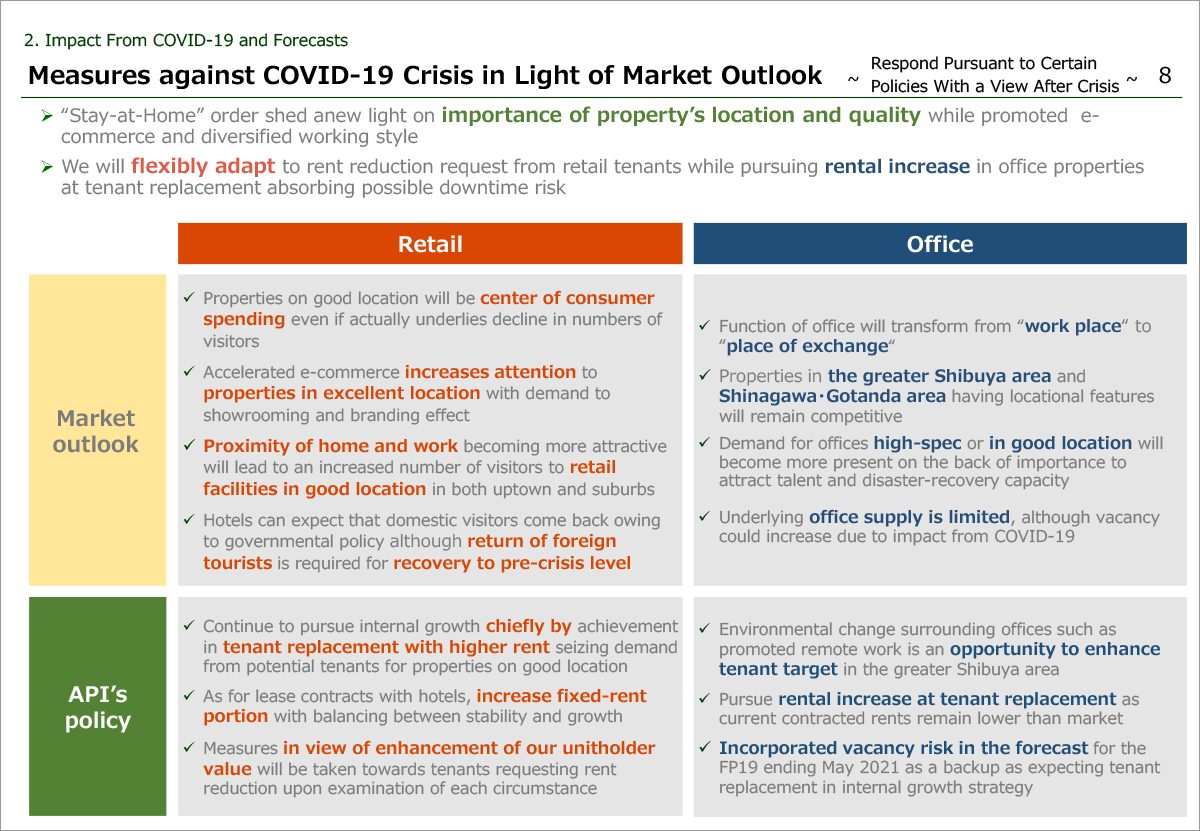

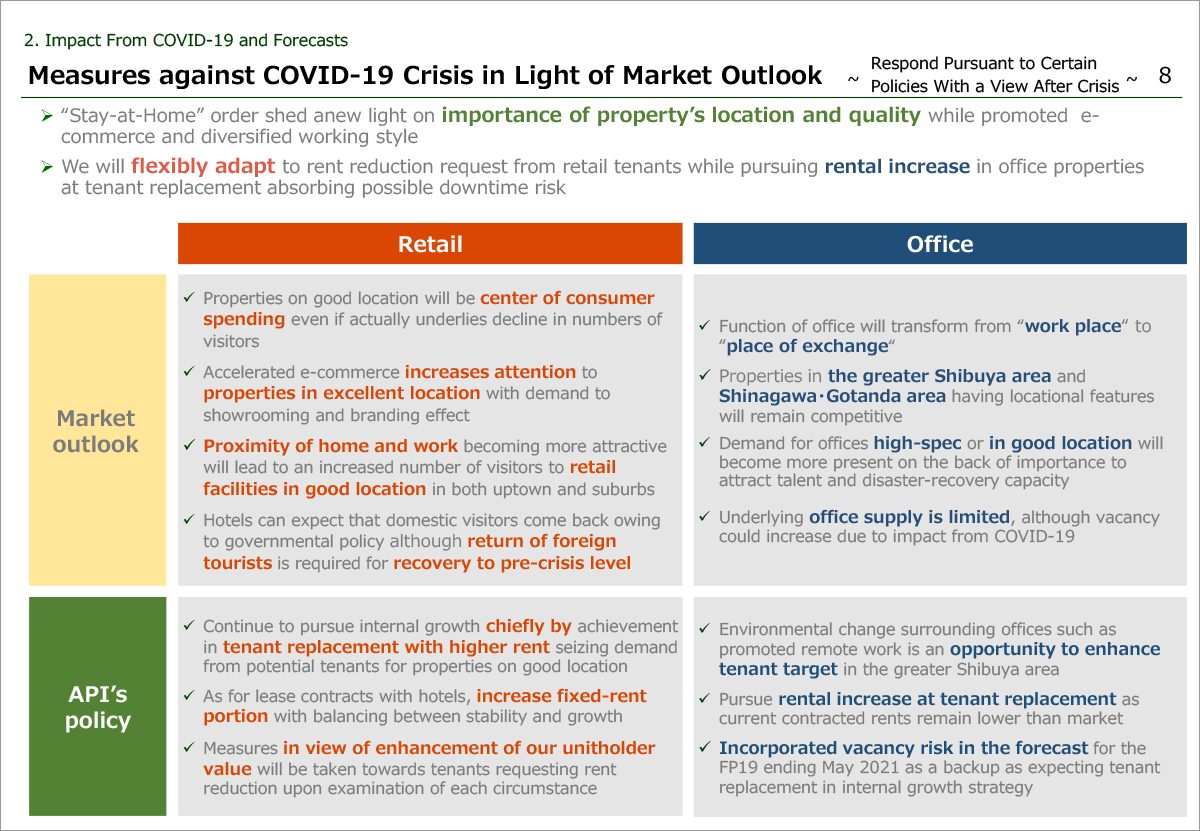

On the slide 8, I would like to explain how we will respond to COVID-19 crisis in light of future market outlook.

Stay-at-home order as a preventive measure against COVID-19 promoted people’s spending in e-commerce and diversification of working style. We consider that even if the underlying trend became apparent as such, as for retail properties and offices which are our investment target, the significance of those location and quality will gain more presence.

Even after crisis, facilities in good location will remain center of consumer spending, and as e-commerce promoted, those facilities will attract further attention on the back of the function of those stores to serve to increase brand awareness.

As for offices, their role is changing from “workplace” to “place of exchange” and location of the properties will be more significant same as retail facilities. High spec offices will also gain importance from a point of view of talent attraction and disaster-recovery capacity.

Since office supply is forecasted limited for next two years, we are not thinking the market will get worse as a level lastly seen after the Lehman Brothers crisis, even if close attention to be paid to a certain rise in vacancy.

Our response to COVID-19 crisis in light of the market outlook is as follows. For retail properties, we will continue to pursue internal growth at tenant replacement as we confirmed a solid demand for the properties in good location. As to relief requests, we will watch each tenant’s circumstances and deal with individually.

Hotels need more time to expect return of foreign tourists, though we will seek balancing between stability and growth through taking measures such as increase of fixed-rent.

For offices, while we have opportunities to broaden the range of tenant candidate backed by recent change of office’s function which will encourage movement of tenants and to achieve rental increase at following tenant replacement, we have to pay attention to risks such as prolongation of downtime.

Against those risks, we incorporated a certain amount of buffer into the forecast DPU, which allows us to pursue intensively internal growth.

Please move to the next slide.

|

|

|