|

|

|

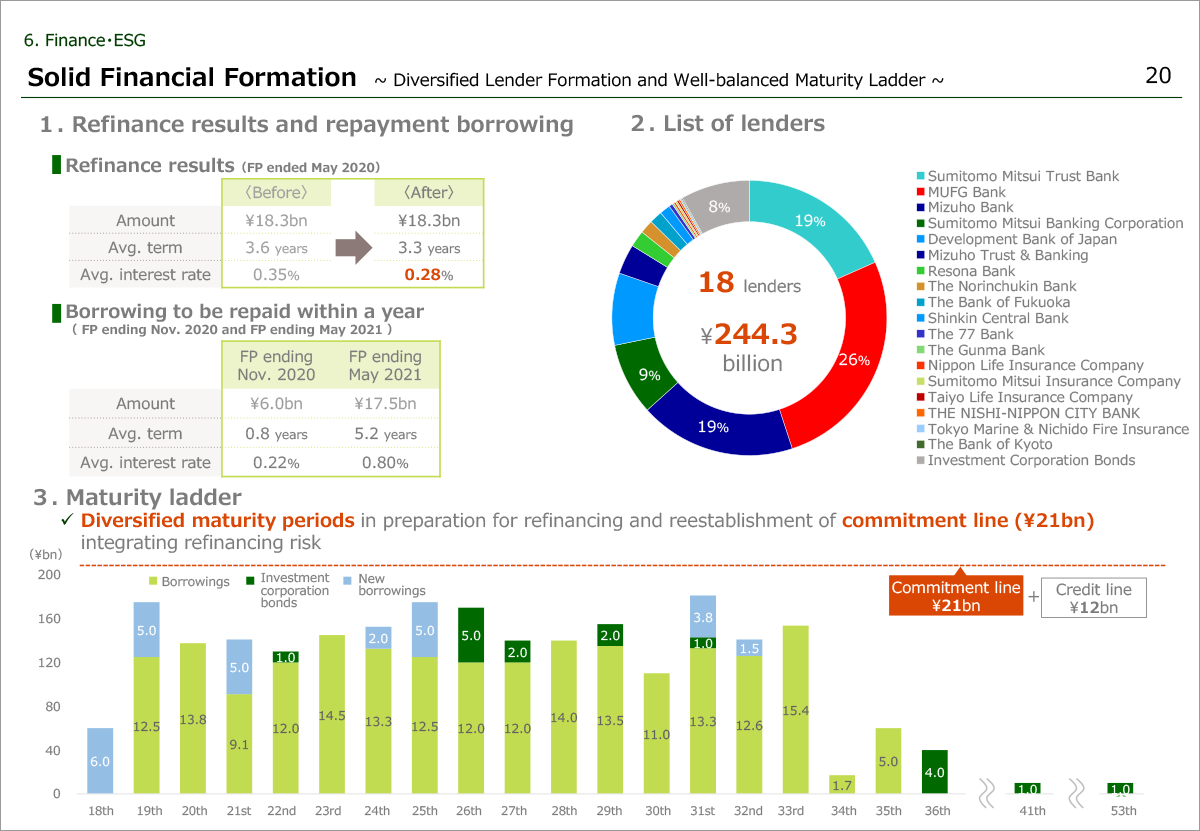

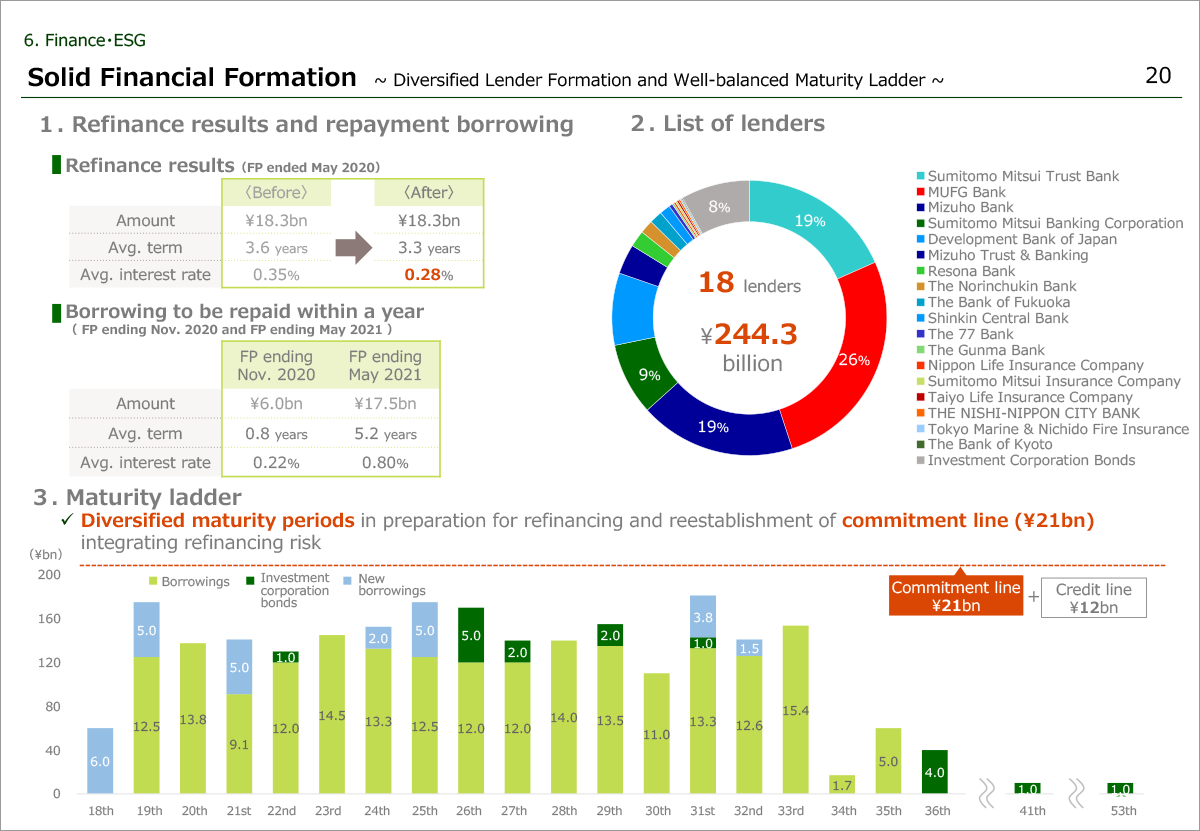

Recent refinance results and borrowings subject to repayment within a year are shown here.

We have continued to lower average interest rate, and we will work to lower further interest rate by refinance for the future as the rate of debts to mature during FP19 is relatively high, as you can see in the below table.

On the right side you can see the list of lenders.

We are now borrowing total ¥244.3 billion from 18 lenders. Forming the such solid bank formation, we will continue to achieve stable financial management facilitating smooth communication.

The maturity ladder is shown in the bottom.

We have managed to level the outstanding amount and average interest rate of debt maturing at each period paying attention to refinancing. We have diversified maturity periods not to be inclined to specific period and recontract commitment line (¥21 billion) to secure flexibility.

|

|

|