|

|

|

|

|

|

|

|

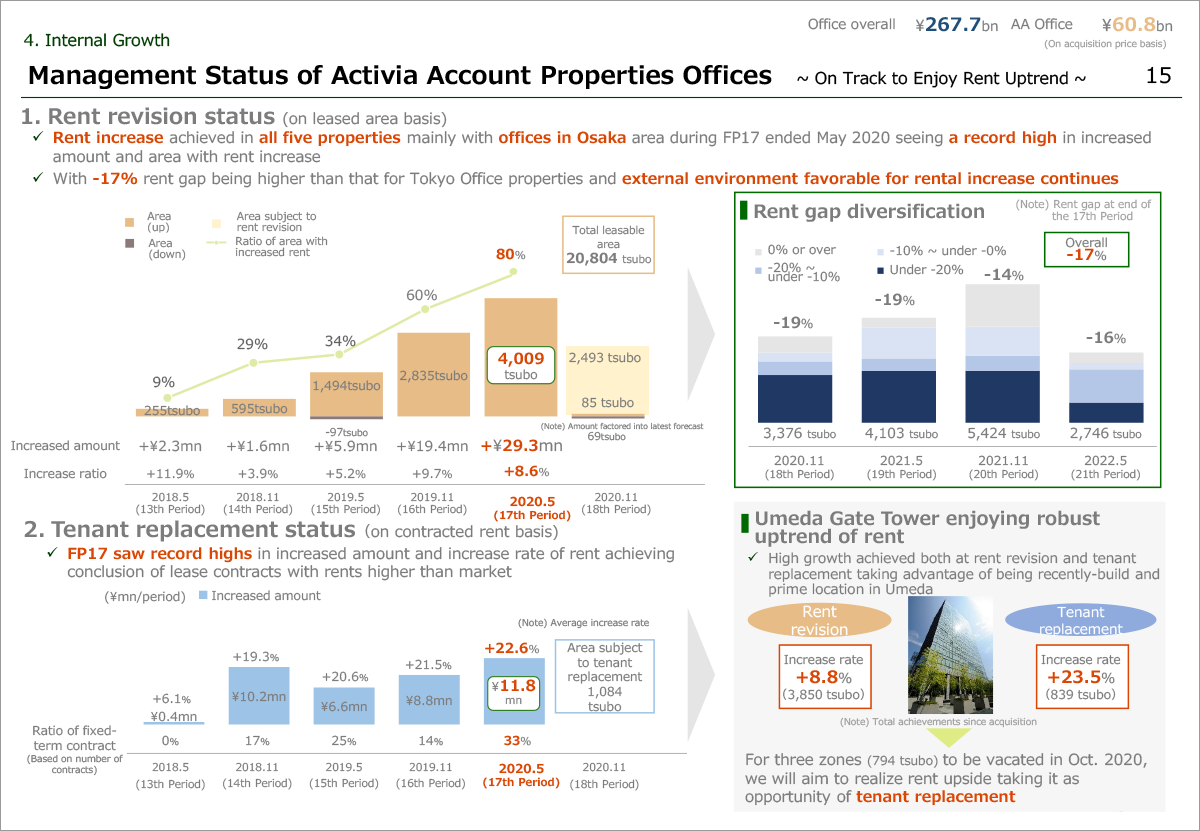

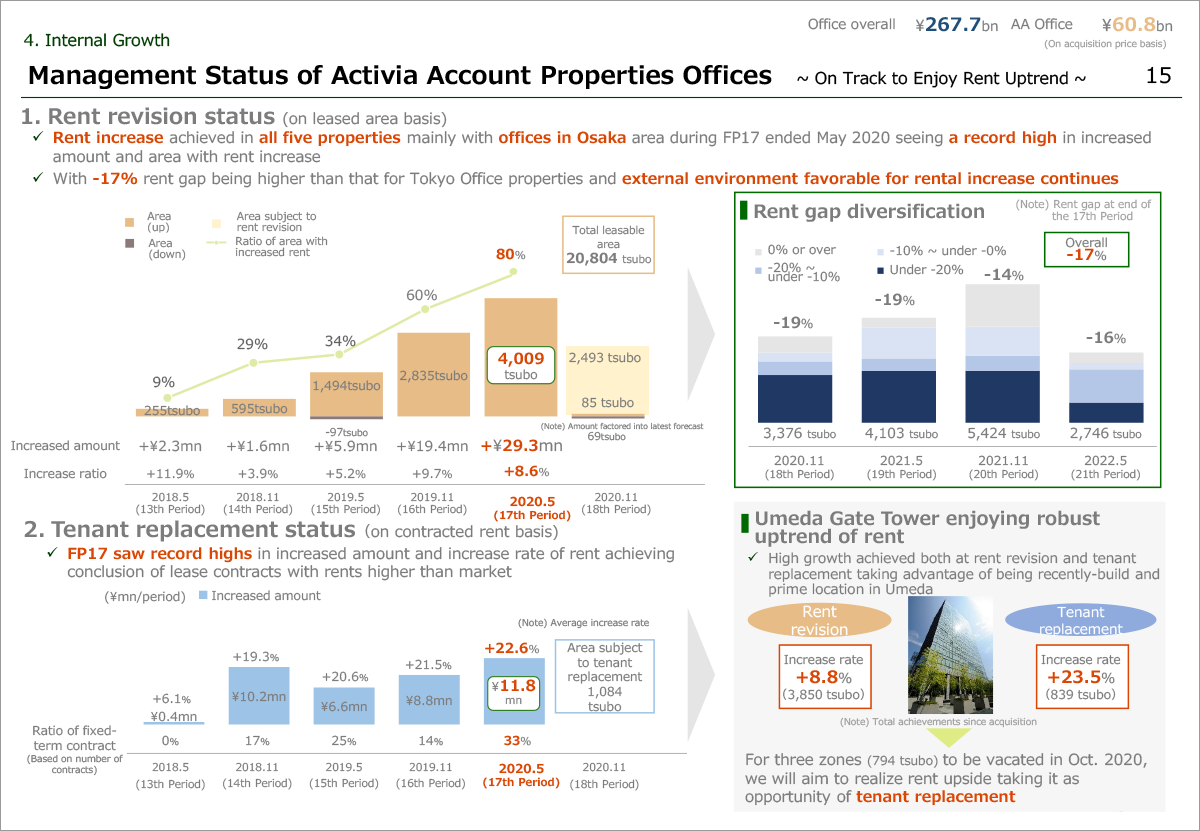

I would like to explain here management status of offices of Activia Account properties.

Offices of Activia Account properties increase their presence period by period, and we see no sign of letting up even amid COVID-19 crisis.

For the period under review, we have achieved rental upward revision in 4,009 tsubo or 80% of total area subject to rent revision and earned ¥29.3 million, hitting a record high of increased amount, same as Tokyo Office properties.

Among the five office properties, all of which we achieved upward rent revision, Umeda Gate Tower and Osaka Nakanoshima Building and EDGE Shinsaibashi are the three showing stronger uptrend.

The rent gap diversification in offices of Activia Account properties is shown on the right side.

Overall rent gap stood at -17%, slightly shrink by 4pt from the previous period, though rent gap of AA office is still greater than Tokyo Office properties.

Further, as supply of large-sized offices is not forecasted in Osaka before 2022, market will remain more strained than Tokyo and we expect further internal growth in the category.

On the bottom, you can see our achievements at tenant replacement.

In the period under review, we increased rental revenue to ¥11.8 million with an average increase rate of 22.6%.

For FP ending November 2020, approximately 1,100 tsubo will be subject to tenant replacement, and we are working for leasing aiming at further rental increase. This area includes the 794 tsubo cancelled by an important tenant in Umeda Gate Tower as disclosed in April.

As the property has maintained a robust rent growth since we acquired in April 2016 and demand remains solid even under recent circumstances, we continue to strive for an earliest lease up.

Please move on to the next slide.

|

|

|