|

|

|

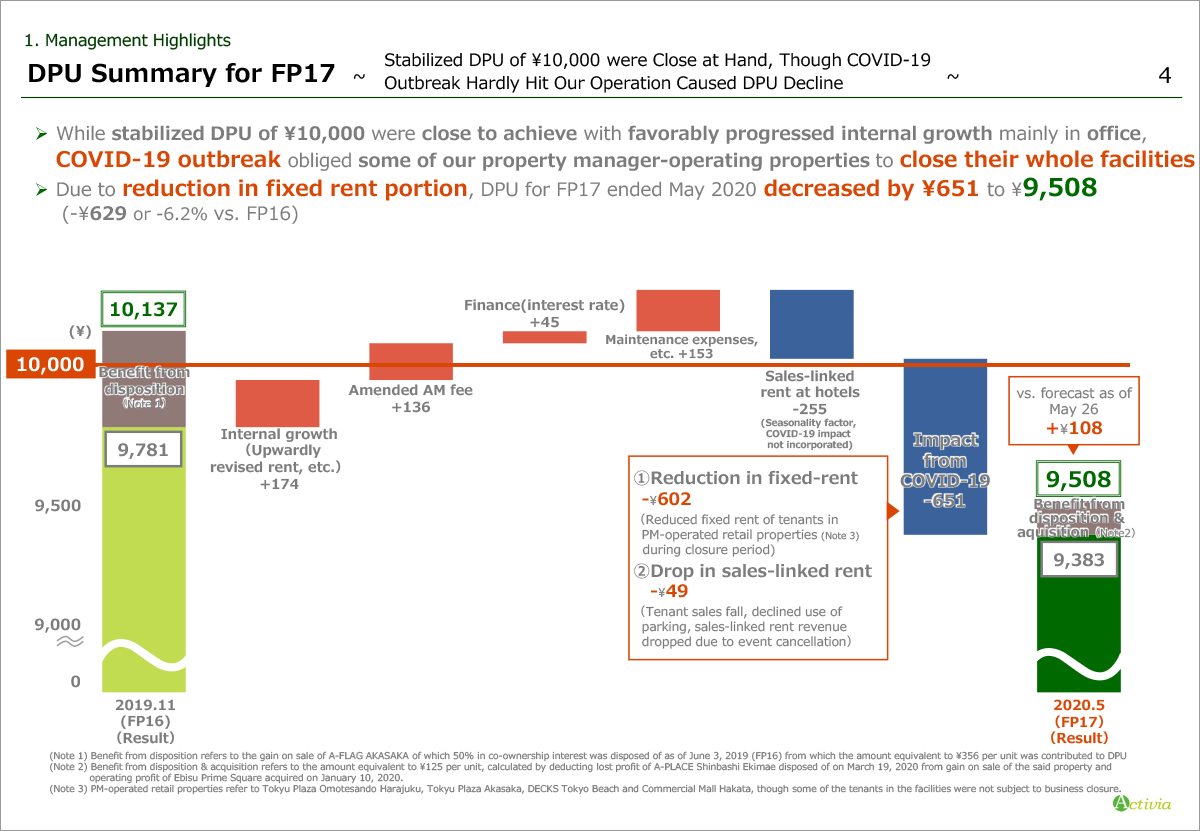

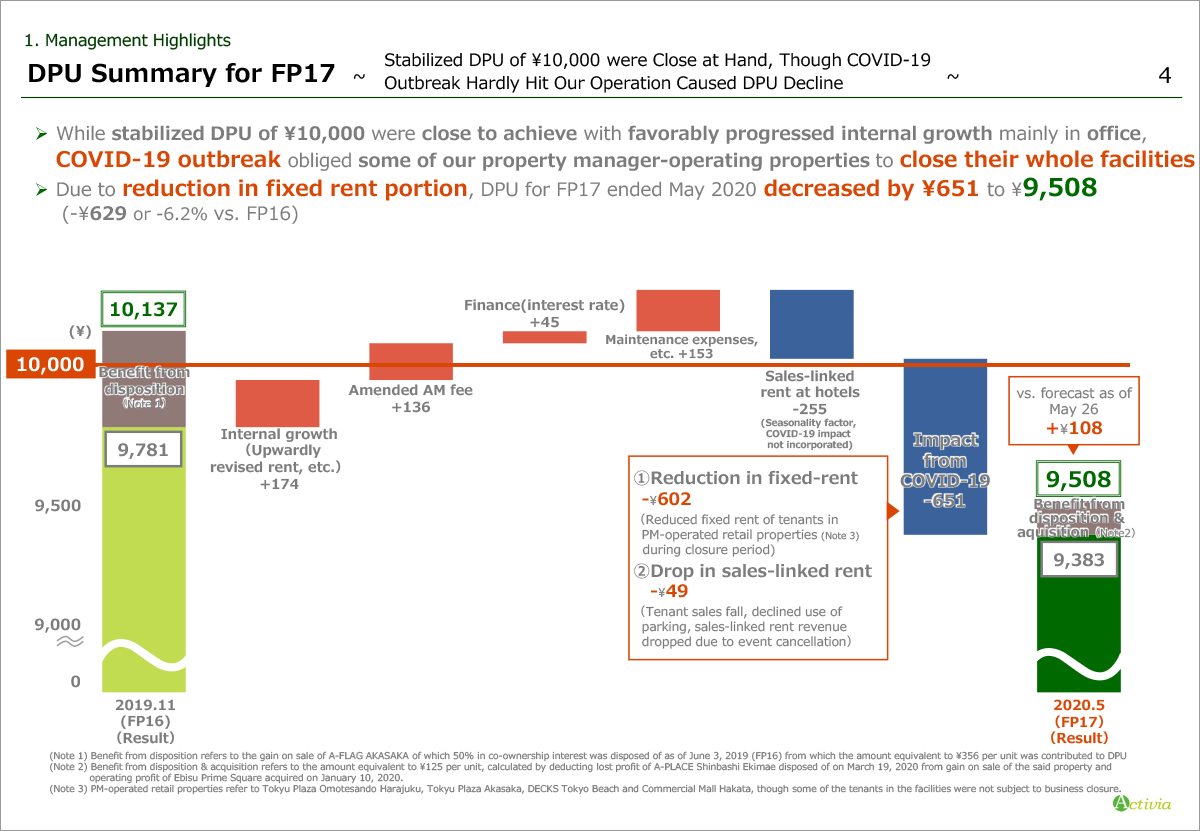

Slide 4 summarizes DPU for the period under review.

At the beginning of the period, management had been firmly progressed, with achieving rental increase in office and benefitting from the reduced asset management fee of which the structure has been recently amended, and the DPU of ¥10,000 were almost close at hand.

Then from February where COVID-19 outbreak reached Japan and infection spread became serious, we decided as a preventive measure to close four of our commercial facilities namely Tokyu Plaza Omotesando Harajuku, Tokyu Plaza Akasaka, DECKS Tokyo Beach and Commercial Mall Hakata.

And for the tenants of those facilities, we reduced fixed portion of rent during the closure period.

Incorporating a minus of ¥651 as the revenue loss due to COVID-19 pandemic, DPU for the period under review resulted to be ¥9,508, even though edged up from the latest forecast announced on May 26, it recorded a decrease by ¥629 or 6.2% from the DPU of the previous period.

|

|

|