|

|

|

|

|

|

|

|

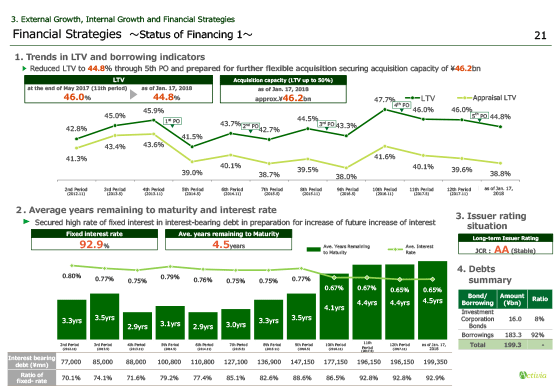

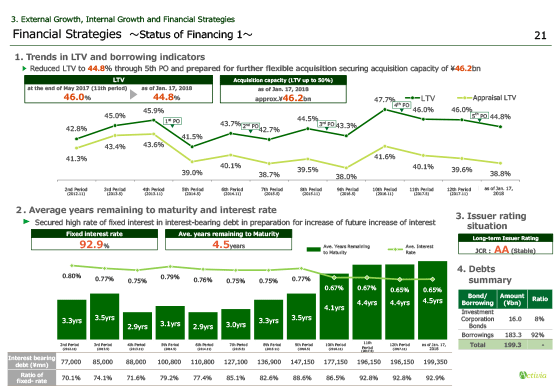

From this page, I would like to explain our financial strategies.

No.1 at the top is about LTV and acquisition capacity.

After the fifth PO, LTV was lowered by 1.2 point from 46.0% (at the end of the 11th and 12th periods) to 44.8% as of January 17, 2018.

Financial capabilities to acquire properties are considered at ¥46.2 billion assuming LTV level as 50%, which would allow further flexible acquisition.

The average years remaining to maturity and interest rate are shown in the second point in the bottom.

Along with the fifth public offering, we made additional borrowings of ¥3.2 billion on January 5, 2018. Our stable financial base has been maintained with a fixed-interest rate of 92.9% and an average remaining years to maturity of 4.5 years as of January 17, 2018.

The average interest rate has decreased to 0.65%, down 0.02 point from the end of the previous period.

As you see in No.3 and 4 at the bottom right, our long-term issuer rating of JCR is AA, with the outlook "stable". The total amount of borrowings is ¥199.3 billion including investment corporation bonds of ¥16.0 billion and borrowings of ¥183.3 billion.

|

|

|