|

|

|

|

|

|

|

|

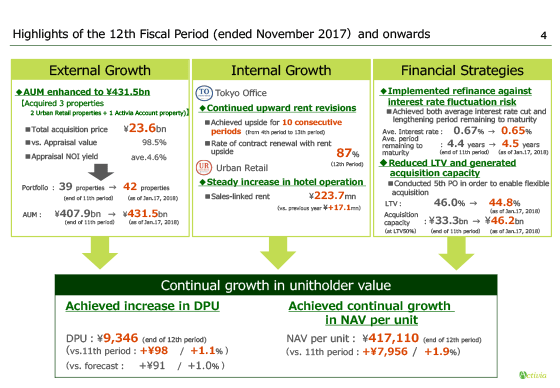

The page 4 shows the highlights for the 12th period and onward.

The first point is external growth. As explained earlier, as per acquisition of new properties through the offering, we have acquired three properties with a total acquisition price of ¥23.6 billion, and the number of properties increased to total 42 properties, and our AUM grew to ¥431.5 billion on acquisition price basis.

The second point is internal growth.

In Tokyo Office properties, we succeeded in upward rent revision for 10 consecutive financial periods from the fourth period, with rent revision achieved in 87% of all tenants, which is the highest rate ever.

In Urban Retail properties, hotels continued to perform steadily during the 12th period, and sales-linked rents at hotels stood at approximately ¥233.7 million, grew by ¥17.1 million, 8.3% from the previous year.

And the third point is financial strategies. We have continuously achieved both lowering interest rate and extending years remaining to maturity since the previous period.

As of January 17, 2018, the average interest rate is 0.65%, down 0.02 point from 0.67% at the end of the previous period. And the average years remaining to maturity is 4.5 years, extended 0.1 year from 4.4 years at the previous period.

As a result of our efforts focusing on the above three points, distributions per unit for the 12th period reached ¥9,346, steadily increasing 1.1% or ¥98 from those of the previous period, and ¥91 from the forecast. Furthermore, NAV per unit was ¥417,110, up 1.9% from the previous period.

Please proceed to the next page.

|

|

|