|

|

|

|

|

|

|

|

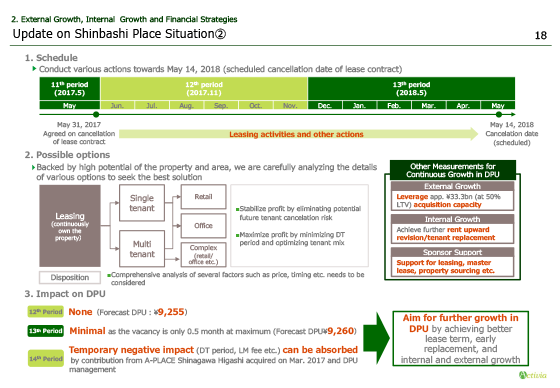

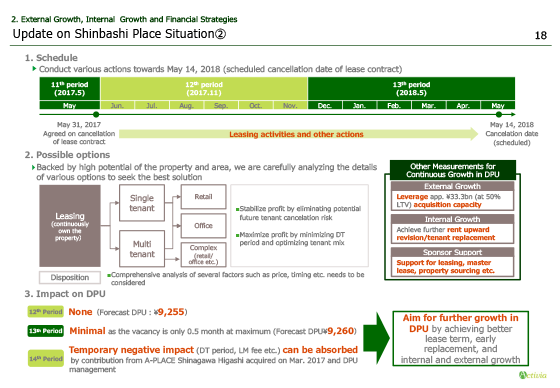

No.1 at the top of page 18 lays out our schedule for "Shinbashi Place".

We already began leasing activities after agreement to termination of the contract at the end of May, and we consider the appropriate course of action keeping aware of the timeline towards contract termination on May 14, 2018.

No.2 in the middle of the page outlines our counterplan.

There is a wide array of options available for this property such as targeting single tenants or multi-tenants, leasing as an office or as a retail, based on the strong potential of the area as well as the quality of the property as explained beforehand. First and foremost, it is our mission to put into place the most effective plan that ensures maximization of profit.

No.3 at the bottom presents the impact on distributions for each period.

There will be no impact for the 12th period since the termination date, May 14 2018, comes during the 13th period. Furthermore, we believe that the impact on the 13th period will be minimal considering that the maximum vacancy period is only half a month.

In the 14th period, despite the temporary downtime and possibility for leasing costs due to tenant replacement, we believe that the impacts can be absorbed through the profit contribution of the acquisition of "A-PLACE Shinagawa Higashi" and our DPU management.

Additionally, we aim an increase from the forecasted DPU ¥9,255 for the 12th period and ¥9260 for the 13th period, through internal and external growth resulting from improvement of conditions upon tenant replacement as well as increased rents at rent renewal and tenant replacement for the entire portfolio.

Please turn to the next page.

|

|

|