|

|

|

|

|

|

|

|

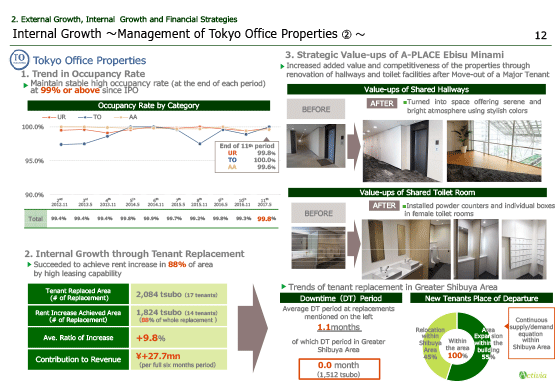

On the page 12, No 1 on the left shows the historical occupancy rates by asset category.

At the end of the 11th period, we achieved a high occupancy rate of 99.8% in overall portfolio, with "Urban Retail Properties" at 99.8%, "Tokyo Office Properties" at 100% and "Activia Account Properties" at 99.6%.

No 2 in the bottom left shows the status of tenant replacement. While the previous page shows upward rent revisions by rent renewal, this page presents rent revisions by tenant replacements.

In the 11th period and onward, rent was upwardly revised for 88% of target floor area with a ratio of increase of 9.8% and a contribution to revenue of ¥27.7 million per normalized period.

Additionally, in the Greater Shibuya Area, where a tenant turnover cycle is forming, replacement is carried out without downtime. Downtime period for "Tokyo Office Properties" as a whole is only 1.1 months.

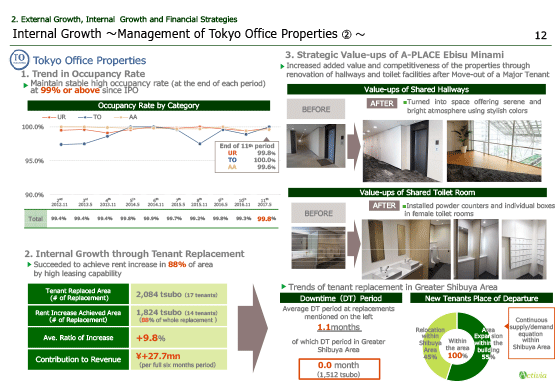

No 3 in the upper right shows the strategic renovation aimed at increasing value that was implemented in "A-PLACE Ebisu Minami".

We explained in the presentation of the previous period about the favorable leasing situation of the property in which there was no downtime for an entire section of the property from which a major tenant exited. After that tenant exited, we conducted a large-scale renewal focused on shared areas such as space around elevators, as well as hallways and toilet facilities for further internal growth.

Please turn to the next page.

|

|

|